Technology has transformed industries by enhancing access to information and boosting productivity. However, it has also played a significant role in exacerbating the wealth gap. The following 19 startling facts shed light on how technological advancements contribute to growing economic inequalities:

Automation and Job Displacement

Automation is replacing jobs traditionally held by low and middle-income workers with manufacturing, retail and administrative roles becoming increasingly automated. The surge in automation has left many without employment or the means to transition to new industries, meaning wealthier individuals, who own an automated business or can retrain, benefit financially, exacerbating economic disparities.

Tech-Driven Income Polarization

High-paying tech jobs are mainly concentrated in urban hubs like Silicon Valley, which is not accessible to all. Working in technology sectors often means earning much more than those in traditional industries, further widening the pay gap between tech workers and non-tech workers.

Digital Divide

Access to technology remains uneven with wealthy households able to afford high-speed internet, advanced devices and digital literacy tools. In comparison, lower-income families often struggle with outdated technology or no access at all, creating a divide when it comes to opportunities for education and remote work.

Unequal Education Opportunities

Technology has enhanced education, but primarily for those who can afford it. Online learning platforms, coding boot camps and digital resources are more accessible to affluent families, giving their children a competitive edge, while underprivileged students often lack the infrastructure to participate fully.

Big Tech Dominance

A few tech giants, such as Apple, Amazon and Google, dominate global markets, creating monopolies that stifle competition from smaller companies. These companies accumulate vast wealth and power, which benefits shareholders and makes it more difficult for small businesses to struggle to compete.

Gig Economy Exploitation

While the gig economy provides flexibility for workers, it often exploits people by offering low wages, minimal benefits and no long-term job security. Platforms like Uber and DoorDash profit greatly from the gig economy, with investors and executives benefiting while workers face economic instability.

AI-Driven Wealth Concentration

Artificial intelligence creates value primarily for those who develop and control it. Companies investing in AI reap massive profits, while workers whose jobs are replaced by AI face unemployment. The benefits of AI advancements rarely trickle down to the broader population.

Global Outsourcing and Wage Suppression

Technology allows companies to outsource labor to countries with lower wages, boosting their profits. While outsourcing cuts costs for businesses, it also lowers wages domestically and contributes to rising economic inequality, as profits are directed to shareholders instead of being reinvested in local communities.

E-Commerce Growth Disrupting Small Businesses

Online retail giants like Amazon have disrupted traditional brick-and-mortar stores. Small businesses, unable to compete with e-commerce’s scale and efficiency, often shut down, eliminating local jobs and redirecting wealth to a few dominant players.

Tech Startups Favoring Investors

Startups often provide enormous returns to venture capitalists and early investors. However, these financial gains rarely extend to employees or the public, as wealth accumulates at the top of the investment chain, leaving average workers with stagnant wages.

Stock Market Accessibility

Technology-driven platforms like Robinhood have made stock trading more accessible, but wealthier individuals still dominate the stock market. With greater capital and resources, rich people can leverage tools and insider knowledge to generate wealth, while small investors often face higher risks and limited returns.

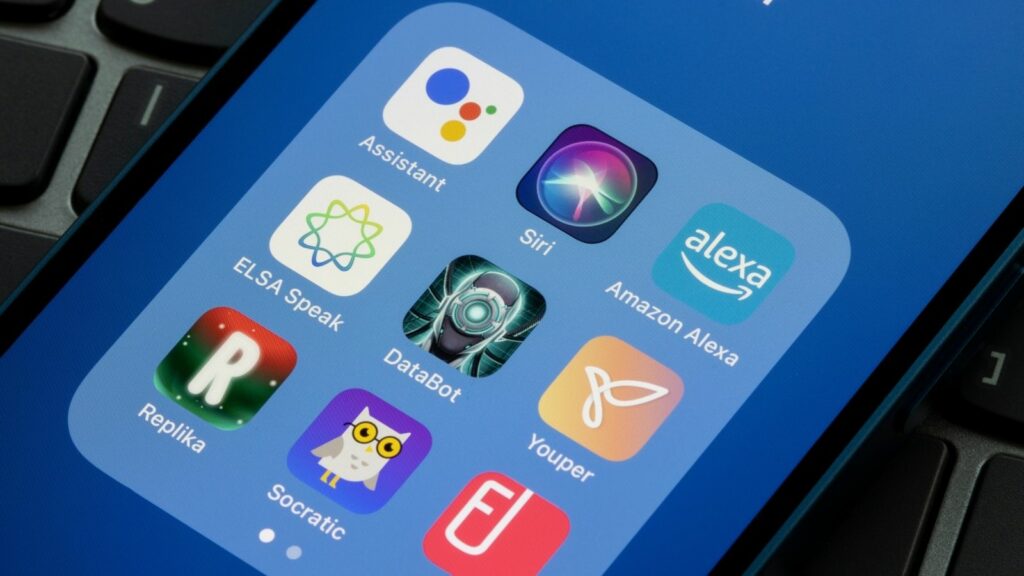

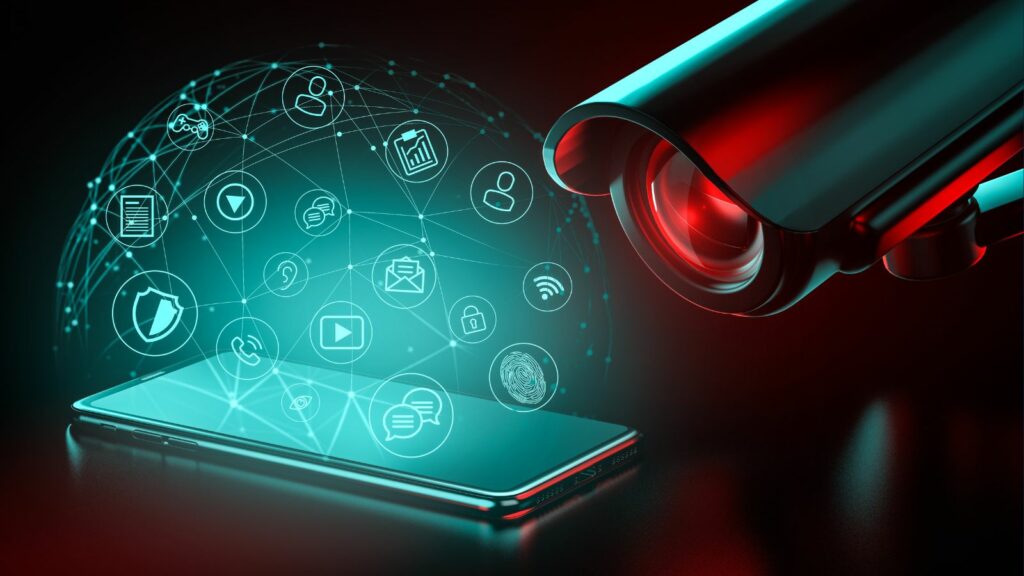

Surveillance Capitalism

Companies profit from collecting and monetizing user data, often without equitable compensation to the public. The wealth generated from this data enriches corporations and executives while everyday users, who produce this data, receive little to no financial benefit.

Tech-Enabled Tax Avoidance

Tech giants often use sophisticated algorithms and offshore strategies to minimize taxes. By avoiding billions in tax obligations, some companies contribute less to the government of revenue that could fund public services.

Cryptocurrency Wealth Concentration

Cryptocurrencies promise decentralized finance, but wealth remains concentrated among early adopters and miners who can afford advanced hardware. The speculative nature of crypto increases financial risks for average investors, who often have little money to lose.

Biased Algorithms in Hiring

AI-driven hiring platforms often reflect biases that favor privileged groups. Wealthier, well-educated candidates are more likely to pass algorithmic screening processes, while those from marginalized backgrounds face systemic barriers to employment.

Healthcare Technology Disparities

Advanced medical technologies are often inaccessible to lower-income populations due to high costs. Wealthier individuals can afford cutting-edge treatments and personalized healthcare, while disadvantaged groups struggle with basic medical access, widening health outcomes and economic opportunities.

Digital Advertising and Small Businesses

Tech giants like Google and Facebook dominate digital advertising, driving up costs for ad space. Small businesses with limited budgets struggle to compete, while large corporations benefit from extensive reach, further consolidating market power and wealth.

Remote Work Opportunities

Remote work enabled by technology favors white-collar professionals with high-paying jobs. Many low-income workers, whose roles require physical presence, are excluded from these opportunities, creating a divide in income growth and job security.

Patent Ownership and Innovation Barriers

Wealthy corporations often secure patents for emerging technologies, creating barriers to innovation for smaller players. By controlling intellectual property, these companies stifle competition and concentrate profits within a small elite group, leaving others with limited economic opportunities.

25 Countries Predicted to Become Economic Superpowers in the Next 20 Years

The strength of an economy plays a crucial role in various international policies about trade and relations. Certain factors determine the strength of an economy, including population growth, availability of resources, and development and advancement. Here are 25 countries predicted to become economic superpowers in the next 20 years

25 Countries Predicted to Become Economic Superpowers in the Next 20 Years