Millennials in Canada face a unique financial landscape shaped by rising living costs, housing challenges, and a rapidly changing job market. Yet, this generation also has access to powerful investment tools, tax-advantaged accounts, and global opportunities that can secure long-term wealth. By starting early and making smart financial decisions, millennials can take control of their future rather than relying solely on pensions or government support. Here are 20 investment tips every Canadian millennial needs right now.

Start Investing Early to Maximize Growth

Starting early is one of the most potent investment strategies for Canadian millennials. The earlier you invest, the more time your money has to grow through compounding. Even small contributions made in your 20s can accumulate significantly over decades. For example, investing CA$200 monthly at a 6% annual return could grow to over CA$400,000 by age 65. Beginning early also helps you build financial discipline and reduces pressure later in life. By consistently contributing small amounts now, you create long-term wealth while taking advantage of time.

Build a Solid Emergency Fund Before Investing

Before investing, it is important to have a strong emergency fund. This acts as a safety net for unexpected expenses such as job loss, car repairs, or medical costs. Financial experts in Canada recommend saving at least three to six months of essential living expenses in a high-interest savings account. Having this cushion prevents you from withdrawing investments at the wrong time or taking on expensive debt during emergencies. By securing your short-term needs first, you ensure your long-term investments remain untouched and continue to grow.

Contribute Regularly to Your RRSP

Contributing to a Registered Retirement Savings Plan (RRSP) is a valuable step for Canadian millennials looking to secure their financial future. RRSP contributions are tax-deductible, lowering your taxable income and allowing your investments to grow tax-deferred until withdrawal. Consistent contributions, even in small amounts, build long-term savings for retirement. Many employers also offer RRSP matching programs, which provide free additional contributions. Making regular RRSP deposits helps you stay disciplined while reducing your tax burden. Starting early and contributing steadily allows compound growth to work in your favour.

Take Advantage of Your TFSA Contribution Room

The Tax-Free Savings Account (TFSA) is one of the most flexible investment tools available to Canadians. Contributions grow tax-free, and withdrawals are not taxed, making it ideal for both short-term and long-term goals. As of 2025, the annual contribution limit is CA$7,000, with unused room carried forward. Millennials can invest in stocks, bonds, ETFs, and GICs within a TFSA to maximize growth potential. Using your TFSA effectively allows you to save for major life events or retirement without worrying about taxes on gains.

Automate Your Investments for Consistency

Automation makes investing simple and consistent for Canadian millennials. Setting up automatic contributions ensures money is invested regularly without relying on willpower. Many banks and robo-advisors offer features that allow automatic transfers into RRSPs, TFSAs, or investment accounts. By investing at set intervals, you benefit from dollar-cost averaging, which reduces the impact of market volatility. Automation also removes the temptation to spend money meant for investments. Even small recurring deposits build wealth over time. Consistency is more important than timing the market, and automating your contributions ensures steady progress toward financial goals while minimizing stress and effort.

Diversify Across Stocks, Bonds, and ETFs

Diversification is a key principle for reducing risk and building strong investments. Canadian millennials should spread investments across stocks, bonds, and exchange-traded funds (ETFs). Stocks provide higher growth potential, while bonds offer stability and steady returns. ETFs give access to diversified portfolios at low cost, reducing individual stock risk. Balancing these assets protects you during market downturns and creates opportunities for steady long-term growth. Diversification also applies across industries and regions, helping reduce reliance on a single market.

Focus on Low-Cost Index Funds

Low-cost index funds are an excellent option for Canadian millennials who want simple, affordable investing. These funds track major indexes such as the S&P/TSX Composite or S&P 500, providing broad market exposure. Unlike actively managed funds, index funds have lower management expense ratios, often below 0.25%, which saves investors money over time. With fewer fees eating into returns, your money grows more efficiently. Index funds are also diversified, reducing the risk of relying on individual stocks.

Invest in Dividend-Paying Stocks

Dividend-paying stocks provide steady income in addition to potential long-term growth. Many established Canadian companies, such as those in the banking, utilities, and telecommunications sectors, regularly pay dividends. These payments can be reinvested to buy more shares, compounding returns over time. Dividend stocks are often considered more stable than high-growth companies, making them valuable during uncertain market conditions. Investors can also use dividend income to cover expenses without selling investments. By including dividend-paying stocks in a portfolio, millennials can benefit from both reliable cash flow and appreciation in value.

Avoid High-Interest Debt Before Investing More

Carrying high-interest debt can significantly limit the benefits of investing. Credit card debt in Canada often carries rates above 19%, which is higher than average long-term market returns. Paying off this debt first provides a guaranteed return equal to the interest saved. For example, eliminating a CA$5,000 balance at 20% interest saves CA$1,000 annually in charges. Once high-interest debt is cleared, funds can be redirected toward investments that grow wealth. Avoiding unnecessary debt also improves financial stability and reduces stress.

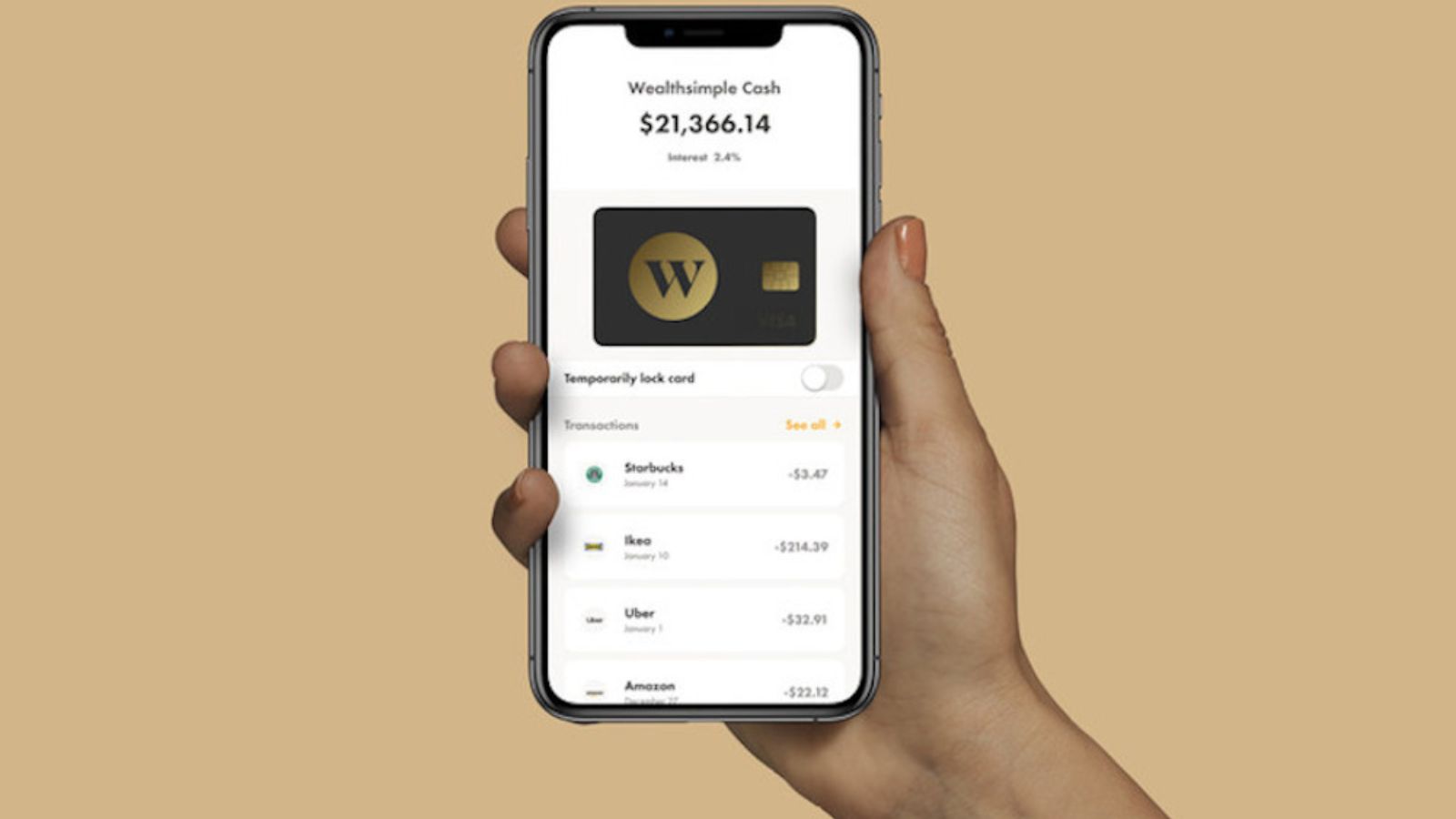

Explore Robo-Advisors for Easy Portfolio Management

Robo-advisors are an accessible way for Canadian millennials to start investing. Platforms such as Wealthsimple and Questwealth use algorithms to build and manage diversified portfolios based on your risk tolerance and goals. Fees are much lower than those of traditional financial advisors, often around 0.25% to 0.50%. Robo-advisors also automate rebalancing, dividend reinvestment, and tax-efficient strategies, making investing hands-off and straightforward. They are ideal for beginners who may not have the time or knowledge to manage investments actively.

Learn About Dollar-Cost Averaging

Dollar-cost averaging is a practical strategy for reducing the impact of market volatility. It involves investing a fixed amount of money at regular intervals, regardless of market conditions. For example, contributing CA$500 monthly into an ETF spreads out purchases over time, buying more shares when prices are low and fewer when prices are high. This smooths out investment costs and prevents emotional decisions based on market swings. Dollar-cost averaging encourages consistent investing and is especially useful for millennials building wealth gradually.

Keep a Long-Term Investment Perspective

Successful investing requires a long-term perspective. Canadian millennials should avoid reacting to short-term market fluctuations, as these are normal and often temporary. Historically, markets have recovered from downturns and delivered growth over decades. Staying invested allows compound returns to work in your favor, even during periods of volatility. Setting clear financial goals and sticking to them prevents emotional decisions that could harm progress. A long-term outlook also helps you remain patient, ensuring you benefit from both market recoveries and growth.

Review and Rebalance Your Portfolio Annually

Rebalancing your portfolio is important to maintain your chosen level of risk and return. Over time, some investments may grow faster than others, causing your portfolio to drift from its original allocation. For example, stocks may increase in value, leaving you with more risk exposure than intended. Reviewing your portfolio annually allows you to sell portions of overperforming assets and reinvest in underweighted ones. Many Canadian robo-advisors also offer automatic rebalancing. This discipline keeps your investments aligned with goals and reduces exposure to unnecessary risks.

Understand the Tax Implications of Investments

Taxes can significantly impact your investment returns if you’re not careful. For example, dividends, capital gains, and interest income are all taxed differently in Canada. Using registered accounts like a TFSA and RRSP can help you legally reduce or defer taxes. However, unregistered accounts require a smart strategy to minimize tax liability. Understanding how withholding taxes apply to U.S. or international dividends is also crucial. By learning the tax rules, you can keep more of your earnings and grow your wealth efficiently.

Invest in Canadian and Global Markets

While Canadian markets offer stability and familiarity, they make up only a small fraction of global investment opportunities. Limiting your portfolio to Canada could mean missing out on growth in international markets. Investing globally—whether through ETFs, mutual funds, or direct stocks—gives you exposure to different economies and industries. This diversification reduces risk and provides access to high-growth regions. Balancing Canadian and global investments ensures you’re not overly dependent on one country’s economy.

Consider Real Estate as a Long-Term Asset

Real estate remains one of the most popular long-term investments for Canadians. Property ownership can provide steady rental income, potential tax advantages, and long-term value appreciation. While the housing market can be volatile, real estate often acts as a hedge against inflation and a way to diversify your portfolio beyond stocks and bonds. That said, it requires substantial capital and ongoing costs like maintenance, taxes, and mortgage payments. Whether through direct ownership, REITs, or real estate funds, adding property to your portfolio can strengthen your financial foundation.

Avoid Following Market Hype and Trends

It’s tempting to chase the latest “hot stock” or cryptocurrency that everyone is talking about. However, emotional investing often leads to buying at high prices and selling at lows. Following market hype exposes you to unnecessary risks and can derail your financial plan. Instead, focus on building a strategy based on your goals, risk tolerance, and timeline. Remember, successful investing is not about chasing quick wins but about consistent, disciplined decisions. By ignoring the noise and sticking to proven strategies, you’ll avoid costly mistakes and achieve more reliable results.

Continue Educating Yourself About Investing

The investment world is constantly evolving, and staying informed gives you a clear advantage. From new asset classes like digital currencies to changing tax regulations, knowledge helps you make better decisions. Read trusted financial blogs, listen to podcasts, or attend workshops to keep learning. Books on investing can also help you strengthen your foundation. By continuously educating yourself, you’ll gain the confidence to analyze opportunities, avoid scams, and adjust your strategy as needed.

Build an Investment Strategy Aligned with Your Goals

Your investments should reflect your personal financial goals, not someone else’s. Start by identifying what you want to achieve—whether that’s saving for a home, funding education, or building retirement wealth. Then, align your risk tolerance and investment choices with those objectives. For example, short-term goals may require safer, liquid investments, while long-term goals can handle more risk. Having a clear strategy prevents you from making impulsive decisions based on market swings.

Seek Professional Advice When Needed

Even the most informed investors sometimes need expert guidance. Financial advisors, tax specialists, or portfolio managers can provide insights tailored to your situation. They can help you structure your investments, minimize taxes, and prepare for major life milestones. While there’s a cost to professional advice, the long-term benefits often outweigh it, especially if it prevents costly mistakes. Look for fee-only or fiduciary advisors who put your best interests first. Seeking professional support when needed ensures your financial journey stays on track and gives you peace of mind.

21 Products Canadians Should Stockpile Before Tariffs Hit

If trade tensions escalate between Canada and the U.S., everyday essentials can suddenly disappear or skyrocket in price. Products like pantry basics and tech must-haves that depend on are deeply tied to cross-border supply chains and are likely to face various kinds of disruptions

21 Products Canadians Should Stockpile Before Tariffs Hit