Government policies influence our financial lives more than we realize, often in ways that go unnoticed. From subtle changes in tax laws to shifts in environmental regulations, these policies can have a far-reaching impact on your personal finances. Here are 20 surprising ways government decisions may be quietly influencing your wallet, for better or worse.

Tax Reform and Deductions

Government tax policies directly influence how much of your income you take home. Changes in tax rates or deductions can significantly impact your financial well-being. Higher tax rates mean paying more in taxes annually, reducing disposable income and affecting your overall financial health.

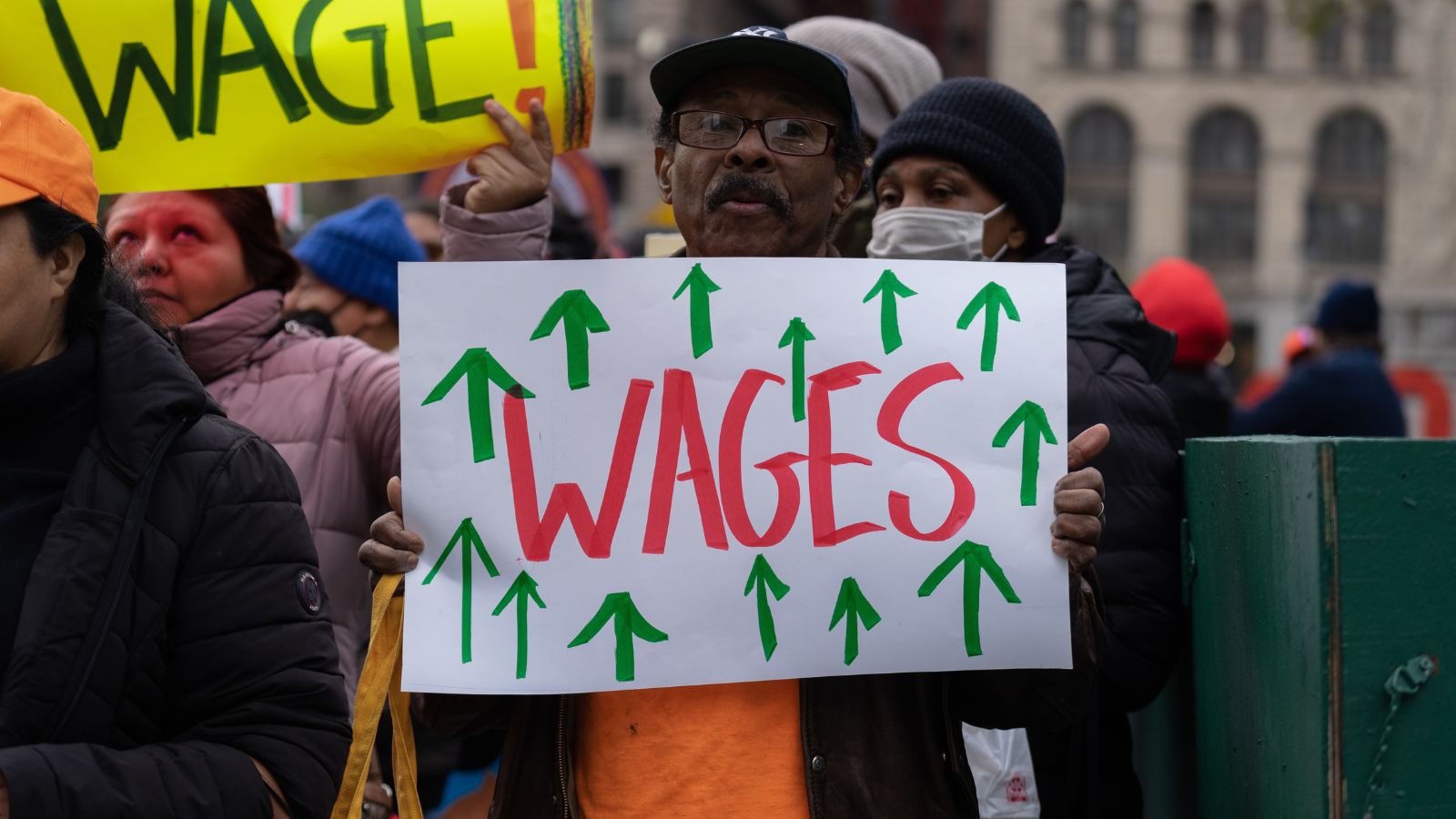

Minimum Wage Increases

While an increase in wages means the workers get to take more income home, it can also contribute to inflation. Many businesses’ typical response to wage increases is an increase in the prices of their goods and services, thus affecting the purchasing power of middle—and high-income earners.

Healthcare Policies

Government policies like the Affordable Care Act (ACA) determine how much you have to pay for premiums and the quality of care. Furthermore, government policies can also impact your out-of-pocket expenses and prices of prescription drugs. The unaffordability of healthcare costs often results in reduced access to care or an increase in medical debt.

Student Loan Regulations

Student loan debt remains a significant financial strain for many. Changes in government policies related to student loans can influence interest rates, introduce or alter loan forgiveness programs, and modify repayment plan options. These adjustments can either ease or intensify the financial burden, directly affecting your long-term financial stability and ability to save or invest for the future.

Housing Market Regulations

Government policies have a big say in the housing prices and rents. They can shape housing markets, drive the prices up and down, and even control where houses are built. All of these can contribute to how much one has to pay for the home and its maintenance.

Environmental Regulations

The government’s rigid policies on environmental regulations can drive prices higher, given that companies have to take extra measures to pass them. The burden of these measures is often exacted from the consumers. However, incentives such as solar panel rebates or electric vehicle tax credits can also lower your energy bills.

Social Security Adjustments

Social Security’s benefits are comforting for retirees. However, the government’s adjustments to social security—such as raising the retirement age and changing how cost-of-living adjustments (COLA) are calculated—can reduce the benefits a retiree might receive.

Trade Policies

Tariffs and trade agreements directly affect the cost of imported goods. Higher tariffs on imports of fruits and vegetables or electronics mean a higher price that consumers have to pay for them. Similarly, free trade agreements can lower the cost of many commodities but can also lead to job losses in certain domestic sectors.

Retirement Savings Regulations

The government can change retirement savings policies, such as limiting 401(k) plan contributions or IRAs. This can impact your ability to save for those golden years. Furthermore, taxes imposed by the government can also limit your saving ability.

Corporate Tax Policies

Corporate taxes play a crucial role in funding government services. However, when business tax rates rise, corporations often respond by cutting costs. This can result in reduced employee wages, job cuts, or increased prices for goods and services.

Transportation Policies

Transportation is a daily necessity that has made getting around easier. The government’s transportation policies, such as fuel taxes, public transit investments, and toll regulations, determine the cost of enjoying this privilege. Moreover, subsidies for owning an EV are in place, but they can ultimately lead to higher electricity bills.

Insurance Regulations

Changes in government policies can also affect the highly regulated insurance industry. There’s auto insurance, flood or disaster insurance, and even health insurance that most people rely upon. Fluctuations in government policies can result in you paying more for these insurances.

Welfare Programs

Economic downturns can significantly impact the lives of millions, which is why welfare programs are in place. Programs like unemployment benefits, food stamps, and housing assistance are there to assist people suffering during such trying times. However, changes in government policies regarding this can impact people benefiting from these problems. Additionally, expansions in these programs can lead to a raise in taxes, which everyone has to pay.

Banking Regulations

The Dodd-Frank Act, the Federal Reserve’s monetary policies, and similar other banking regulations determine interest rates, loan availability, and credit terms. Changes in banking regulations can impact the process of qualifying for loans, which is sometimes necessary. Additionally, the government can decrease interest rates, reduce savings and earnings, and make borrowing cheaper. Similarly, it can increase interest rates, which increases your saving returns but makes loans more expensive. These changes can impact everything from homeownership to even your monthly budget.

Energy Policies

The government’s decision on subsidies for renewable energy, fuel taxes, and regulations on power companies directly impact your utility bills. For instance, if the government decides to raise carbon taxes on electricity generated from fossil fuels, you’ll end up paying more for heating or cooling your home.

Employment Laws

Employment laws are in place to ensure the regulations of wages, better working conditions, and enforcement of employee rights. If the government decides to tweak these laws, it can directly impact your job security, benefits, and income. For example, if the government changes the law mandating parental or paid sick leave, you can lose income for something that’s not in your control.

Education Funding

Education is a necessity for every person. Government policies on funding education are directly related to its affordability and quality. For example, if the government decides to cut state funding for public universities, students and their families will have to bear the brunt of a spike in tuition costs.

Food Safety Regulations

Designed to protect consumers, food safety regulations can also contribute to the high cost of food. If the government decides on stricter regulations on food production processes, the cost of production for farmers will increase. Ultimately, consumers will have to pay higher prices as farmers will sell their produce for higher rates.

Public Infrastructure Investments

While public infrastructure investments are necessary for a convenient and easy life for citizens, they can also cost certain people a pretty penny. For example, investments in transportation projects make the lives of many people easier. However, they can significantly increase property prices in nearby areas, which can put an additional burden on renters.

Debt Ceiling and Fiscal Policies

The government’s fiscal policies and debt ceiling have a significant impact on the economy and finances. For instance, if the government hits the debt ceiling, interest rates on everything, including mortgages and credit cards, can increase. Similarly, bad fiscal policies that ultimately lead to higher debt can increase tax rates for citizens.

Conclusion

Government policies are typically designed to benefit citizens, but their effects on your finances can be subtle yet significant. From your paycheck to your grocery and utility bills, the policies set by the government can have a profound impact. Staying informed about these policies is essential for making informed decisions about budgeting, saving, and investing, helping you navigate their influence on your financial well-being.

18 Reasons Why People Are Leaving Florida in Masses

Exploring factors that impact the desirability of living in Florida, this list delves into various challenges shaping residents’ experiences. From environmental concerns like rising sea levels to economic factors such as fluctuating job markets, these issues collectively contribute to a nuanced understanding of the state’s appeal.

18 Reasons Why People Are Leaving Florida in Masses