Canadians and Americans may share a border and countless cultural similarities, but the relationship is not always equal when it comes to business. U.S. brands have long dominated Canadian malls, highways, and convenience stores. However, shifting economics, tightened supply chains, and corporate refocusing mean some of those once-ubiquitous brands are pulling out or shrinking their Canadian presence. These are 20 U.S. brands Canadians might soon lose forever.

Bed Bath & Beyond

Once a go-to store for dorm supplies, bath accessories, and kitchen gadgets, Bed Bath & Beyond was beloved by many Canadians. After years of financial struggles, the company shuttered its U.S. stores and withdrew from Canada entirely. Though some hoped it might revive through online retail or new ownership, it seems unlikely. For Canadians who relied on its sprawling aisles and 20% off coupons, its absence is already being felt.

Sears

Sears Canada once mirrored its American counterpart in offering everything from appliances to back-to-school fashion. After years of decline and failed restructuring, the company disappeared from Canadian malls, leaving a significant retail gap. While Sears limps along in the U.S., its presence north of the border seems permanently erased. Canadians who grew up flipping through its Christmas catalog now see it as a relic of the past.

J.Crew

J.Crew brought a preppy, refined fashion sense that many Canadians welcomed. But financial challenges led the brand to close many Canadian locations in favor of consolidating its U.S. operations. While some availability remains through online shopping or third-party stores, it’s clear the brand is distancing itself from physical Canadian retail. Unless there’s a strategic return, J.Crew may soon be just another U.S. name Canadians remember fondly.

Banana Republic

Part of the Gap Inc. family, Banana Republic once had a prominent presence in Canadian shopping centers. However, in recent years, store closures and shifting business priorities have thinned its footprint considerably. The brand has pivoted toward online and U.S. markets where it sees higher returns. Without renewed investment in Canada, Banana Republic could soon fade entirely from Canadian storefronts.

Victoria’s Secret

Once a fashion force, Victoria’s Secret captivated Canadian consumers with its glamorous branding and sprawling mall locations. But shifting consumer tastes, management controversies, and declining sales have weakened its standing. Store closures and scaled-back operations in Canada signal a potential full retreat. Unless it dramatically retools its brand, Canadians may no longer find those iconic pink bags in local malls.

Toys “R” Us (U.S. version)

Though Toys “R” Us still operates in Canada under separate ownership, the American brand’s ongoing struggle casts a long shadow. The U.S. version filed for bankruptcy, closing hundreds of stores and eroding trust in the franchise. If licensing agreements falter or supply chain ties weaken, even the Canadian branch could face pressure. The fate of the American brand remains a cautionary tale for its northern counterpart.

Macy’s

While Macy’s never had a massive Canadian presence, it remained aspirational for cross-border shoppers and online customers. Now, with the brand struggling to remain profitable even in the U.S., there’s little hope for northern expansion. Macy’s has closed distribution channels to Canada, and some online services no longer ship north. It may never have fully arrived, but now, Macy’s is likely never coming back.

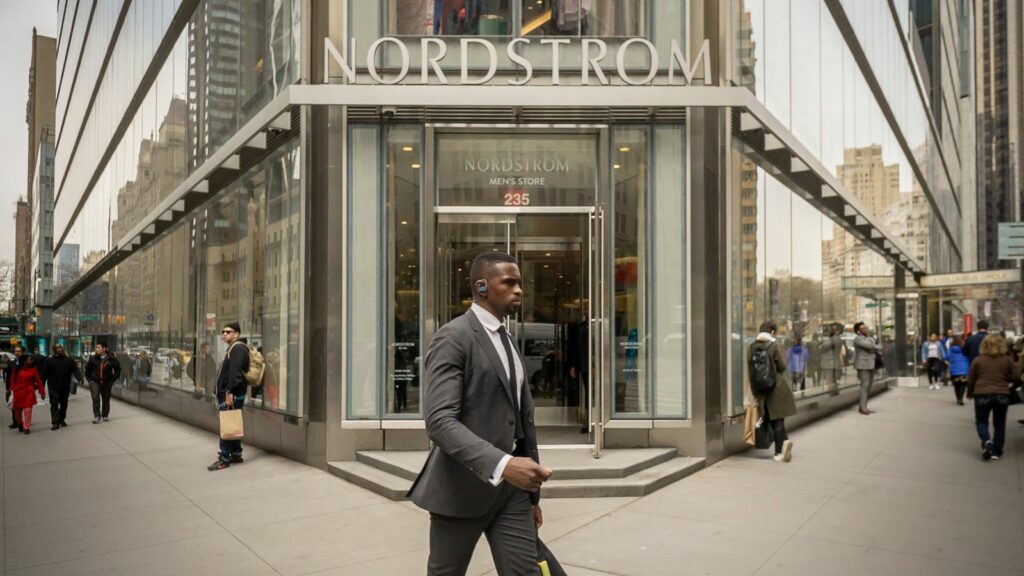

Nordstrom

When Nordstrom launched in Canada, it brought high expectations for luxury department store experiences. But the experiment didn’t last. In 2023, Nordstrom shut down all Canadian stores, citing a lack of long-term profitability. For Canadians who appreciated its quality offerings and upscale service, the loss remains a bitter pill, and there’s little reason to expect a comeback.

Abercrombie & Fitch

Abercrombie & Fitch once dominated teen fashion in Canadian malls with its dark interiors, moody fragrance, and aspirational branding. In recent years, however, many Canadian locations have quietly closed as the brand recalibrates for an evolving marketplace. The company is refocusing on digital platforms and core U.S. markets. For Canadians who still love the brand, online shopping may soon be the only option.

American Eagle Outfitters

While still popular with younger demographics, American Eagle has been slowly reducing its brick-and-mortar presence in Canada. The brand continues to perform well online, but rising operational costs and fewer retail visits make physical stores less viable. Without major investment or adaptation, it risks following the path of other U.S. fashion brands that exited Canada. Continued closures could spell a gradual goodbye.

Old Navy

Old Navy has long been appreciated for its budget-friendly fashion and family-friendly designs. But recent store closures and underwhelming sales have sparked rumors about a potential Canadian exit. The parent company, Gap Inc., is already closing stores globally to cut losses. Unless Old Navy finds renewed momentum, its iconic flip-flop walls may disappear from Canadian malls for good.

Office Depot/OfficeMax

Office supply chains like Office Depot and OfficeMax once had a firm grip on the Canadian B2B and retail scene. But competition from Staples Canada and e-commerce giants like Amazon has decimated their relevance. With very limited presence now and weak performance, they’re likely to abandon Canada entirely. Canadians may have to rely on domestic chains or online giants for their office needs.

Best Buy (under pressure)

Best Buy remains present in Canada but has shown signs of retrenchment, including closing several underperforming stores. As electronics shopping moves increasingly online, the cost of operating large-format stores becomes harder to justify. American corporate strategy may eventually view Canada as a lower-priority market. While not gone yet, Best Buy’s future in Canada seems far from secure.

Bath & Body Works

Loved for its seasonal candles and scented lotions, Bath & Body Works maintains a loyal following in Canada. However, supply chain issues and shifting retail trends have prompted some speculation about reduced international operations. If U.S. leadership prioritizes domestic recovery, Canadian stores could be cut to save costs. A scaled-back presence may leave fans scrambling to stock up before it’s too late.

Kmart

Kmart’s decline in the U.S. has been nothing short of spectacular, leaving only a handful of stores open. While its Canadian exit occurred long ago, some small-format stores and licensing products lingered in northern retail partnerships. Those final remnants are now rapidly disappearing. Even the nostalgic value of Kmart may soon be a thing of the past for Canadian shoppers.

Walgreens

Walgreens has limited Canadian presence, mostly through partnerships and prescription services. However, those ties are thinning as the company faces fierce competition from Shoppers Drug Mart and Rexall. If Walgreens decides to retreat fully to focus on its domestic restructuring, Canadians may lose access to any remaining affiliated services. This quiet exit may not make headlines, but it would still mark the end of an era.

7-Eleven (under review)

7-Eleven has long been a fixture for late-night snacks and quick stops in both countries. However, the brand’s Canadian presence is under increasing scrutiny due to shifting real estate costs and labor challenges. Some regional closures hint at a possible contraction. While it’s unlikely 7-Eleven would vanish entirely, significant pullback could change the urban convenience landscape in Canada.

Chick-fil-A

The U.S. fast-food chain made a splash when it entered Canada, but its growth has been slower than expected. Controversies surrounding its corporate values and resistance from some Canadian communities have complicated its expansion plans. If profits don’t meet expectations, the company may quietly withdraw. Canadians may not miss the politics, but they might miss the waffle fries.

Crate & Barrel

Known for its elegant home furnishings and minimalist design, Crate & Barrel initially gained strong traction in Canada. But more recent store closures and focus on digital sales suggest the brand may scale back further. As U.S. headquarters prioritize profitability and expansion elsewhere, Canadian locations may be deemed expendable. A quiet fade-out could be on the horizon.

Foot Locker

Foot Locker has a noticeable presence in Canadian malls, especially among sneaker enthusiasts. Yet, with declining mall traffic and competition from direct-to-consumer sneaker brands, the company is reevaluating its global footprint. Reports of North American store closures raise concerns for Canadian fans. Without strategic adaptation, Foot Locker’s time in Canada may run out, one pair at a time.

21 Products Canadians Should Stockpile Before Tariffs Hit

If trade tensions escalate between Canada and the U.S., everyday essentials can suddenly disappear or skyrocket in price. Products like pantry basics and tech must-haves that depend on are deeply tied to cross-border supply chains and are likely to face various kinds of disruptions

21 Products Canadians Should Stockpile Before Tariffs Hit