In Canada, wealth-building often seems tied to home ownership, but rising real estate prices have pushed many to look for alternative routes. Fortunately, there’s a wide range of options that can grow your net worth without a single brick or mortgage payment. Here are 20 ways to build wealth in Canada without owning real estate.

Index Fund Investing

Index funds track market benchmarks like the S&P/TSX Composite or S&P 500, offering broad exposure to equities without the need to pick individual stocks. They’re popular because they combine diversification with relatively low management fees. Investors can choose between mutual fund and ETF formats, depending on their preference for automation or flexibility. Over the long term, index funds have historically delivered competitive returns, often outpacing actively managed funds after fees. For Canadians, using accounts like the TFSA or RRSP to hold these investments can make gains tax-free or tax-deferred, significantly enhancing compounding. The key is consistency; regular contributions amplify growth.

Dividend Growth Stocks

Dividend-paying companies reward shareholders with regular income while also providing the potential for stock price appreciation. Focusing on firms with a strong record of increasing dividends annually, often called “dividend aristocrats,” can create a growing passive income stream. Sectors like Canadian banks, telecom, and utilities have a long history of stable payouts. Reinvesting dividends through a DRIP (Dividend Reinvestment Plan) accelerates portfolio growth by purchasing more shares without additional cash outlay. Investors should research payout ratios, cash flow stability, and industry trends before committing, ensuring the company can maintain and grow its dividends regardless of economic conditions.

Exchange-Traded Funds (ETFs)

ETFs provide a convenient way to invest in a wide range of assets, stocks, bonds, and commodities—while keeping costs low. Many ETFs are passively managed, tracking indexes, while others are actively managed with strategic goals. Canadians can buy sector-specific ETFs (e.g., tech, energy) or global market ETFs to spread risk. The liquidity of ETFs means investors can buy and sell them during trading hours, unlike mutual funds. Holding them in a TFSA or RRSP maximizes tax efficiency. They’re also accessible for small budgets, with many available for under $50 a share, allowing gradual portfolio building without large upfront costs.

Bonds and Fixed-Income Securities

While they don’t offer the same growth potential as equities, bonds provide stability and predictable income, making them an important part of a balanced portfolio. Government bonds, corporate bonds, and GICs (Guaranteed Investment Certificates) each offer varying yields and risk profiles. In Canada, GICs are particularly safe as the CDIC often insures them. Bonds can be purchased directly, via ETFs, or through bond mutual funds. They’re useful during market downturns, as they tend to be less volatile. Plus, laddering maturities, staggering when bonds mature, help maintain liquidity and take advantage of potentially higher future interest rates.

High-Interest Savings Accounts (HISAs)

While HISAs won’t make you rich overnight, they provide a secure place for cash to grow while staying easily accessible. Online banks and credit unions often offer better rates than traditional banks. Using a HISA for your emergency fund ensures that your safety net isn’t eroded by inflation as quickly, especially if you choose accounts with promotional or consistently high rates. HISAs are CDIC-insured, adding another layer of protection. For those who are risk-averse or need short-term liquidity, they’re a simple but effective way to earn interest without exposing funds to market volatility.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms connect investors directly with borrowers, cutting out traditional financial institutions. Investors can earn higher returns compared to standard savings accounts or GICs by funding personal or business loans. The trade-off is higher risk, so diversification is essential, spreading funds across many loans minimizes losses if a borrower defaults. Canadian platforms like Lending Loop focus on small business loans, offering transparency on borrower profiles and credit ratings. While returns can be attractive, investors must understand that P2P lending isn’t covered by CDIC insurance, so due diligence and risk assessment are critical.

Building a Side Business

Starting a side business can generate additional income streams that grow over time. This could be anything from e-commerce to consulting to offering specialized services. Low start-up costs and online platforms have made it easier than ever to launch ventures with minimal risk. A side business offers more control over income potential compared to traditional investments. Profits can be reinvested into the business to fuel growth or diversified into other investments. While it requires effort and commitment, the scalability of a successful business can rival or surpass returns from many conventional investment options.

Freelancing and Contract Work

Freelancing turns skills into income without the constraints of a traditional job. Platforms like Upwork, Fiverr, and specialized industry marketplaces connect Canadian freelancers to global clients. Common fields include writing, design, programming, marketing, and consulting. Earnings can be saved or invested, directly contributing to wealth-building. Freelancing offers flexibility, choosing projects and setting rates, but it also requires consistent client acquisition and discipline. Those who treat it like a business, focusing on building a personal brand and network, often find it a sustainable income stream that complements other investments.

Digital Products and Online Courses

Creating digital products, such as eBooks, templates, or online courses, allows creators to earn income with minimal ongoing effort once the product is developed. Platforms like Teachable, Gumroad, and Udemy simplify hosting and sales, while social media and email marketing help reach potential customers. Digital products can have high profit margins since there’s no physical inventory. Topics can range from professional skills to hobbies, as long as there’s a market demand. Over time, a portfolio of products can generate steady passive income, which can be reinvested into other wealth-building avenues.

Investing in REITs (Real Estate Investment Trusts)

REITs let investors participate in real estate markets without direct property ownership. They pool funds to invest in income-producing properties like malls, office buildings, and apartments, paying dividends from rental income. Publicly traded REITs can be bought and sold on stock exchanges like any other equity. For Canadians, REIT ETFs offer additional diversification across multiple trusts. They’re a way to benefit from real estate’s income potential while avoiding the headaches of maintenance, tenants, and property taxes. However, like all equities, REIT prices can fluctuate with market conditions and interest rates.

Stock Options and Covered Calls

Selling covered calls involves holding a stock and selling the right for another investor to buy it at a set price within a given timeframe. It generates income from the option premium, even if the stock isn’t sold. This strategy works best with stable, dividend-paying stocks you’re willing to sell at the strike price. While it can reduce upside potential if the stock surges, it offers an additional revenue stream for long-term shareholders. Canadians can execute covered calls in taxable accounts or registered plans, though certain account rules and tax implications apply.

Robo-Advisors

Robo-advisors like Wealthsimple Invest or Questwealth automatically build and manage portfolios based on your goals and risk tolerance. They typically use low-cost ETFs and periodically rebalance to maintain their target asset allocation. Fees are significantly lower than those of traditional financial advisors, making them attractive for those who want a hands-off approach. Many robo-advisors also include features like dividend reinvestment and tax-loss harvesting. They allow Canadians to start investing with small amounts and grow their portfolio steadily without requiring deep market knowledge or daily monitoring.

Precious Metals and Commodities

Investing in gold, silver, or other commodities can serve as a hedge against inflation and currency fluctuations. Canadians can buy physical bullion, coins, or invest via ETFs and mining company stocks. While commodities don’t produce income, they can hold value during economic instability, balancing a portfolio that’s heavy in equities. The prices can be volatile, influenced by global supply and demand, interest rates, and geopolitical events. Also, for those with a long-term view, a modest allocation to precious metals can enhance diversification and reduce overall risk exposure.

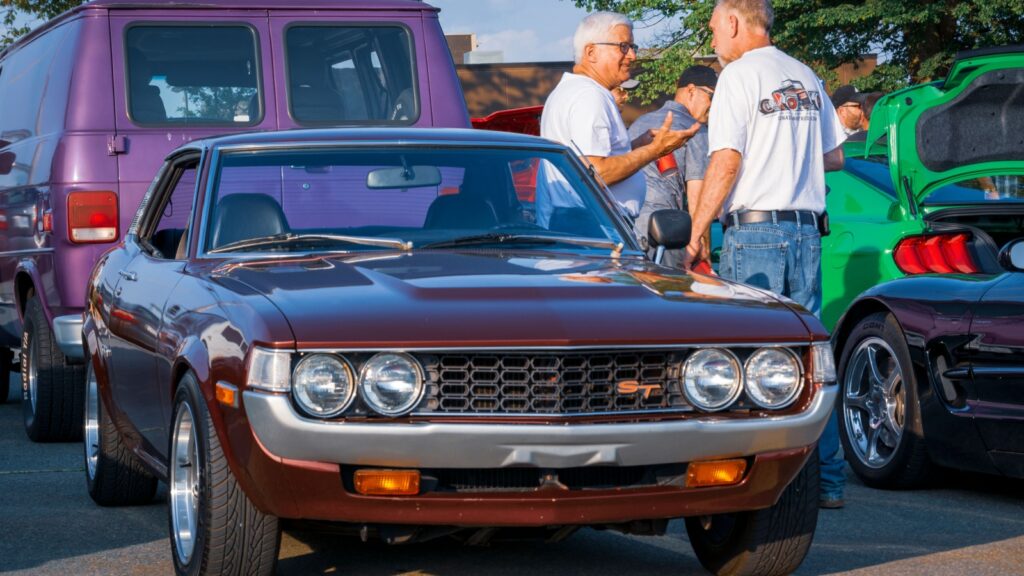

Collectibles and Alternative Assets

Rare collectibles, such as art, vintage watches, classic cars, or limited-edition sneakers, can appreciate over time if demand grows. Investing in these assets requires specialized knowledge to identify items with true long-term value. Storage, insurance, and authenticity verification are important considerations. While less liquid than traditional investments, collectibles can yield significant returns when sold at the right time. Online marketplaces and auction houses have made it easier to buy and sell globally, increasing potential buyer pools and price competition.

Investing in Startups

Equity crowdfunding platforms allow individuals to invest in early-stage companies for a potential share of future profits. In Canada, platforms like FrontFundr provide access to startups across various industries. While returns can be substantial if the business succeeds, the risk of loss is high, as many startups fail. Investors should diversify across multiple ventures and invest only what they can afford to lose. Plus, thoroughly reviewing business plans, leadership teams, and market potential is essential before committing capital.

Tax-Advantaged Accounts

Maximizing contributions to tax-sheltered accounts like the TFSA and RRSP can significantly improve net returns. The TFSA allows investment income and withdrawals to remain tax-free, while the RRSP defers taxes until withdrawal, often at a lower rate during retirement. Using these accounts to hold high-growth or income-generating assets magnifies the benefit. Contribution limits reset annually, so consistent funding over time builds substantial wealth. Coordinating TFSA and RRSP use with other financial strategies ensures optimal tax efficiency and compounding potential.

Skill Development and Education

Investing in your own skills can have one of the highest returns by increasing earning potential. This could mean formal education, professional certifications, or learning new technical abilities. Many programs are eligible for tax credits or can be subsidized by employers. Enhanced skills can lead to promotions, higher salaries, or new career opportunities, directly impacting long-term wealth accumulation. In an evolving job market, continuous learning also safeguards employability, ensuring income remains resilient despite economic changes.

Passive Income Apps and Platforms

Apps like Neighbor (storage rentals) or affiliate marketing networks offer income opportunities with minimal time commitments after setup. Affiliate marketing allows you to earn commissions by promoting products online, while storage rentals monetize unused space in your home or garage. These platforms usually handle transactions and marketing, leaving you to manage availability and quality. While not a primary income source at first, consistent effort and optimization can turn them into meaningful supplementary revenue streams.

Sustainable and ESG Investments

Environmental, Social, and Governance (ESG) investing focuses on companies that meet certain ethical and sustainability criteria. Canadian investors can choose ESG-focused ETFs or mutual funds that align with their values. Many of these companies operate in growth sectors like clean energy and technology. While financial performance is still the primary driver, ESG funds can also appeal to those seeking impact alongside returns. Plus, as global sustainability initiatives expand, these investments may see increased demand and potential appreciation.

International Market Investing

Expanding beyond domestic investments can reduce risk and open new growth opportunities. International ETFs or mutual funds provide exposure to emerging markets, global tech leaders, or specific regions with high growth potential. Currency fluctuations can either enhance or detract from returns, so diversification remains important. Access to foreign markets can also be achieved through global dividend stocks or ADRs (American Depositary Receipts). Not to mention, a well-balanced global allocation can help mitigate risks associated with overreliance on the Canadian economy.

21 Products Canadians Should Stockpile Before Tariffs Hit

If trade tensions escalate between Canada and the U.S., everyday essentials can suddenly disappear or skyrocket in price. Products like pantry basics and tech must-haves that depend on are deeply tied to cross-border supply chains and are likely to face various kinds of disruptions

21 Products Canadians Should Stockpile Before Tariffs Hit