It’s no secret that prices fluctuate depending on where you shop, but few realize how dramatically some Canadian goods skyrocket once they cross the border. From pantry staples to luxury beauty products, American shoppers often find themselves shelling out twice as much for the same item proudly made north of the 49th parallel. Here are 21 Canadian products that Americans often pay double for.

Lululemon Apparel

While the athleisure giant is now global, its Canadian roots are undeniable. Canadians typically pay about $98 CAD for a pair of Align leggings, while Americans often shell out $118 USD, roughly $160 CAD after conversion. The difference stems partly from currency fluctuations, but U.S. retail pricing also bakes in higher logistics and market demand. Americans also face fewer regional markdowns; Canadian stores frequently run “We Made Too Much” sales earlier. The brand’s cult following south of the border means Americans rarely see discounts, and with limited local production, they end up paying a premium just to look comfortably athletic.

Maple Syrup

Authentic Grade A maple syrup from Quebec is one of Canada’s most beloved exports, and one of the priciest imports in the U.S. A 1-litre bottle that costs $14 CAD in Ontario can retail for over $25 USD in American specialty stores. Export costs, tariffs, and middleman markups inflate prices significantly. Many U.S. stores also market it as a “gourmet” product, further driving up retail value. While Americans can buy cheaper syrups, true Canadian maple syrup remains the gold standard, with its labor-intensive production process, taking around 40 liters of sap to make one liter, justifying the higher base cost before export.

Roots Clothing

Roots’ cozy sweatshirts and leather goods represent peak Canadian casual fashion. In Canada, a signature Roots hoodie costs around $88 CAD, while in the U.S., the same model often sells for $120 USD. Americans are essentially paying about 50–70% more after exchange. The brand’s limited U.S. presence and higher operational costs for cross-border shipping play a huge role. Since Roots has fewer physical stores in America, importers handle much of the logistics, passing those costs to consumers. Ironically, many American tourists make a point of visiting Roots stores while in Canada, buying in bulk before heading home to save money.

Ketchup Chips

This snack icon barely exists south of the border, making it a novelty item for American chip lovers. A standard-size bag that costs $2.99 CAD at any Canadian grocery store can retail for $6–8 USD online or in specialty snack shops in the U.S. The markup reflects both shipping costs and scarcity. Since Frito-Lay doesn’t officially distribute ketchup chips in America, the few bags available are imported through third parties. The flavor’s cult status among snack enthusiasts adds to its resale price, people willingly pay more just to taste the Canadian oddity they’ve seen raved about online or on TikTok.

Canada Goose Jackets

The parka that screams luxury winterwear costs a fortune no matter where it’s sold, but even more so in the U.S. A men’s Langford Parka costs around $1,750 CAD domestically, while American stores list it for $1,695 USD, about $2,300 CAD when converted. Canada Goose maintains strict pricing policies, yet the import tariffs and U.S. luxury retail markups widen the gap. Additionally, American consumers often buy from department stores or online boutiques with added fees. Canadians benefit from local pricing and fewer distribution layers, while Americans pay extra for what’s essentially a Canadian winter necessity turned global fashion statement.

Tim Hortons Coffee

Buying a can of Tim Hortons ground coffee in a Canadian supermarket might set you back $12 CAD, but that same can retails for $20–25 USD online in the U.S. The extra cost arises from import duties and niche demand. Many Americans view Tim Hortons coffee as a cultural symbol, comparable to how Canadians feel about Dunkin’. Since it’s not widely stocked in American grocery chains, third-party sellers capitalize on nostalgia and novelty. Shipping coffee grounds across the border also triggers specific labeling and food-handling costs, making that “double-double” a little too expensive outside the Great White North.

MAC Cosmetics

MAC started in Toronto before becoming a global beauty staple. Despite being sold worldwide, American shoppers often pay significantly more per product. For example, a MAC lipstick retails for about $27 CAD in Canada but costs $25 USD in the States, around $37 CAD after conversion. That’s a roughly 35% markup for U.S. buyers. Manufacturing still happens in North America, but brand pricing follows international standards, not home-country cost structures. Canadians also enjoy more frequent promotions and loyalty perks at local outlets, while Americans get the same items under the prestige category, which inflates retail value even further.

Herschel Supply Co. Bags

Vancouver-based Herschel Supply Co. became synonymous with minimalist backpacks. In Canada, a Little America backpack costs around $130 CAD, but in the U.S., the same design is listed at $140 USD, about $190 CAD. Despite being widely available, U.S. distribution adds intermediary costs through retail partners like Nordstrom or Urban Outfitters. Additionally, Americans pay more for shipping and taxes since most fulfillment centers are in British Columbia. The brand’s positioning as a “premium Canadian lifestyle” accessory lets retailers maintain higher margins abroad, turning what’s a practical commuter bag at home into a boutique-priced accessory overseas.

Club House Spices

The humble line of Club House seasonings is a Canadian pantry essential but turns into a luxury import in the States. A 130g jar of Montreal Steak Spice costs about $6 CAD locally and up to $12 USD on American Amazon listings. Because the brand doesn’t have a U.S. production base, imported items face higher customs and labeling costs. While McCormick owns the parent company, the original Canadian blends, like Garlic Plus or La Grille, aren’t sold in American grocery chains. For many American home cooks who’ve tasted them abroad, the steep online prices are the only way to restock their spice racks.

Sorel Boots

Sorel, founded in Kitchener, Ontario, became famous for functional yet stylish winter boots. In Canadian stores, a women’s Joan of Arctic boot sells for around $270 CAD, while the U.S. equivalent retails for $240 USD, roughly $325 CAD. The extra cost covers import logistics, brand tariffs, and higher regional markups. Americans also often purchase from department stores that charge luxury-level margins compared to Canada’s outdoor retailers. With Sorel’s rugged reputation tied to authentic Canadian winters, it’s ironic that Americans pay more to wear boots designed for conditions they’ll rarely experience, except maybe during the occasional East Coast blizzard.

Kawartha Dairy Ice Cream

This Ontario-born dairy brand’s ice cream is beloved for its creamy texture and nostalgic flavors. In Canada, a 1.5L tub sells for around $8 CAD, but imported versions in the U.S. can reach $14–16 USD in boutique grocery stores. Transport costs for frozen goods make distribution expensive, and since Kawartha Dairy has limited U.S. retail presence, small batches are sold as “artisanal Canadian ice cream.” Many Americans who’ve visited Muskoka or Ontario cottage country are willing to pay steep prices to relive that vacation taste. Unfortunately, with dairy tariffs and refrigeration expenses, indulgence doesn’t come cheap abroad.

Joe Fresh Clothing

What’s affordable fast fashion in Canada becomes noticeably pricier in the U.S. Joe Fresh T-shirts, sold for $12 CAD domestically, often appear for $20–25 USD online. Though once stocked at JCPenney, the brand retreated from American malls years ago, leaving limited resellers and online markups in its wake. Because Joe Fresh primarily distributes through Loblaws and Superstore chains, there’s no direct infrastructure for cost-efficient U.S. sales. Americans who still love its clean aesthetic and seasonal collections end up paying boutique-level prices for what’s essentially budget-friendly Canadian wardrobe basics.

Burt’s Bees Lip Balm

Though the brand is American-owned today, much of its beeswax supply still comes from Canadian sources. A single balm stick costing $5 CAD in Toronto can cost $8–10 USD in parts of the U.S., depending on retailer and packaging type. Shipping, import duties, and “natural product” taxes in certain states push up the final cost. Ironically, the balm’s Canadian ingredients, like sustainably sourced wax and honey, contribute to that premium. While Canadians toss them into their baskets as an impulse buy, Americans often pay nearly double just to keep their lips from freezing in their own milder winters.

Peace by Chocolate Bars

The Syrian-Canadian family behind Peace by Chocolate built a heartfelt brand in Nova Scotia, and it’s now internationally beloved. In Canada, a single 60g bar costs around $6 CAD, but American buyers frequently pay $10–12 USD in gift shops or online. Limited export quantities and fair-trade sourcing contribute to the markup. Every bar’s sale supports refugee employment initiatives, which American retailers highlight as part of the “feel-good luxury” appeal, justifying higher pricing. Despite the cost, the product remains in demand as an ethical indulgence, proving that even compassion-driven Canadian chocolate can turn into a high-end import item abroad.

Aldo Shoes

Montreal-based Aldo is a fashion staple with global recognition, but Americans typically pay 30–50% more per pair. A popular boot priced at $140 CAD might retail for $130 USD (about $175 CAD) in the U.S. Differences in pricing stem from American operational overheads, localized marketing, and brand-tier segmentation. In the States, Aldo competes with higher-end mall brands, whereas in Canada it sits closer to affordable fashion. That strategic pricing difference makes the same shoes appear “premium” south of the border, even though they’re identical products from the same distribution centers.

Ruffles All Dressed Chips

Another snack that causes cross-border envy, Ruffles All Dressed chips sell for $4.99 CAD in Canada but up to $9 USD in American stores that stock them. Although Ruffles is a U.S. brand, the “All Dressed” flavor was born in Canada and still primarily produced there. Limited American distribution and niche marketing as an “international flavor” raise prices. Many U.S. retailers even repackage them as imports to justify higher tags. For snack lovers unfamiliar with the flavor, somewhere between barbecue, salt, and vinegar, the inflated cost doesn’t deter them from trying a taste of Canadian chip culture.

Hudson’s Bay Blankets

The classic multistripe wool blanket symbolizes Canadian heritage and craftsmanship. A queen-sized Hudson’s Bay Point Blanket costs about $495 CAD domestically but retails for $495 USD in the U.S., nearly $670 CAD after conversion. The steep difference reflects luxury positioning and shipping costs for heavyweight wool goods. Since most are made in England under license, U.S. retailers import through multiple channels, adding to expenses. The brand’s association with Canadian history and exclusivity helps justify the markup, especially for American buyers seeking “authentic Northern heritage” décor. It’s both a blanket and a status symbol across the border.

Vita Vie Jewelry

This Montreal-based jewelry brand focuses on minimalistic gold-plated designs that retail for about $85 CAD per piece in Canada but are sold for around $120 USD (nearly $165 CAD) on American e-commerce sites. The difference comes down to international logistics and luxury branding. U.S. online boutiques categorize Vita Vie under “Canadian artisanal jewelry,” automatically increasing perceived exclusivity. With shipping, import duties, and boutique commission fees, Americans end up paying almost double. While Canadians pick up these pieces at local pop-ups or small retailers, their American counterparts must settle for inflated prices just to wear the same aesthetic simplicity.

Icewine

This specialty dessert wine, produced mainly in Ontario’s Niagara region, is significantly more expensive in the U.S. A 375ml bottle costing $50 CAD locally can exceed $90 USD in American wine shops. The delicate production process, harvesting grapes frozen on the vine, already makes it costly, but tariffs and limited export volumes compound the price abroad. Since U.S. states regulate alcohol distribution differently, importers often add several layers of markup. As a result, what’s a local luxury at home turns into a near-collector’s item south of the border, making it one of the most expensive Canadian beverages per sip in America.

Arc’teryx Outdoor Gear

Headquartered in North Vancouver, Arc’teryx has a reputation for producing high-performance outdoor apparel. In Canada, a Beta AR jacket costs around $900 CAD, while the same one retails for $900 USD, roughly $1,220 CAD after conversion. The discrepancy arises from uniform global pricing strategies that ignore currency fluctuations. Americans also pay higher import taxes since most garments are made in Asia and shipped to U.S. warehouses. Despite the premium, the brand’s “engineered by Canadians for extremes” image keeps it desirable. U.S. consumers pay nearly double for what’s designed a few hundred kilometers north of their own mountains.

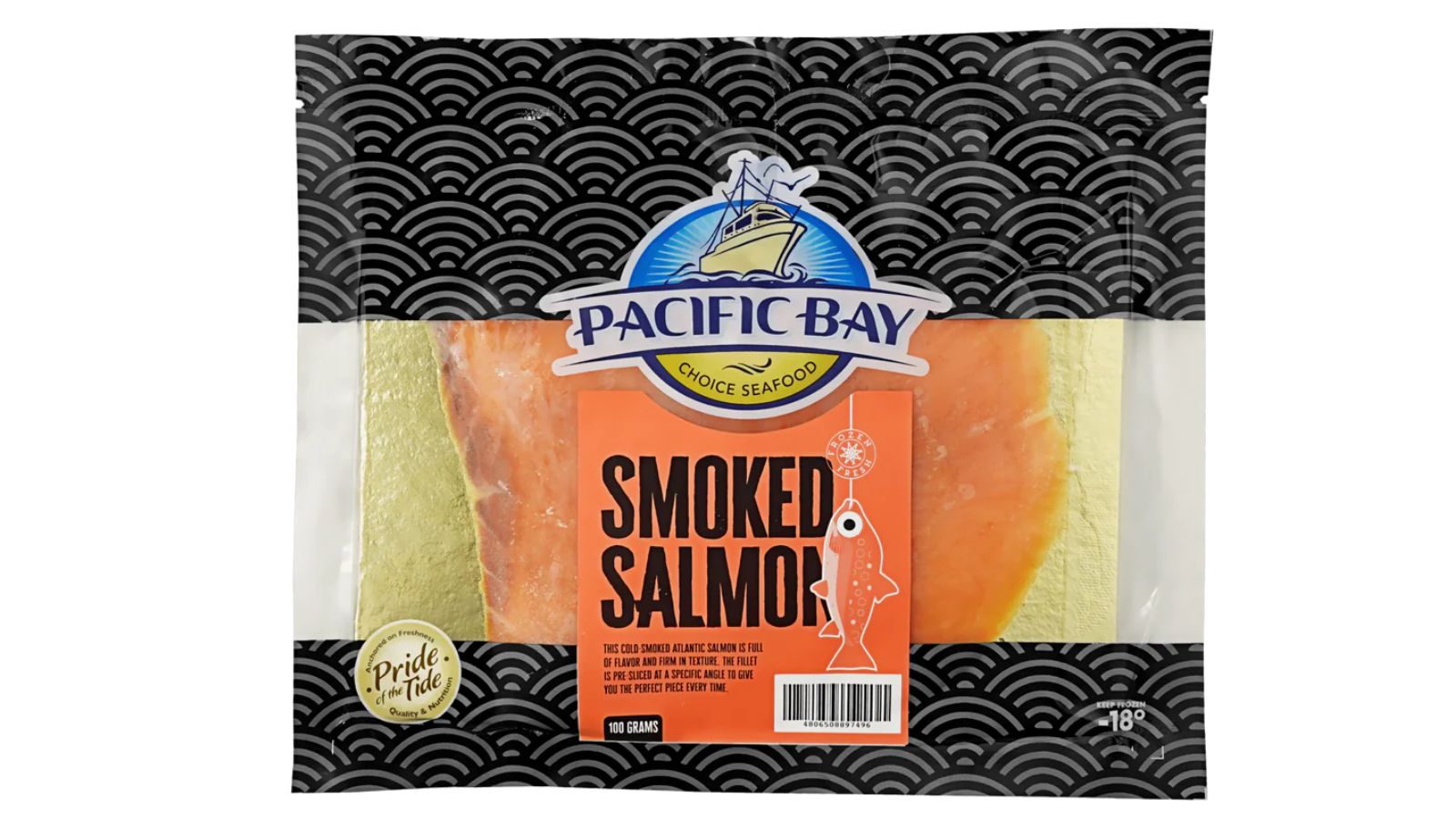

Smoked Salmon from British Columbia

Wild-caught Pacific smoked salmon, especially from BC, is a delicacy that doubles in cost once exported. A 200g pack costs around $15 CAD locally but sells for $25–30 USD in American gourmet stores. Strict food-import regulations, refrigeration requirements, and limited supply chain options all drive up costs. Additionally, branding it as “Canadian wild-caught” adds a premium for American buyers who associate it with sustainability and purity. Despite the markup, demand remains strong in major U.S. cities like New York and San Francisco, where chefs and food enthusiasts willingly pay double for authentic Canadian coastal flavor.

21 Products Canadians Should Stockpile Before Tariffs Hit

If trade tensions escalate between Canada and the U.S., everyday essentials can suddenly disappear or skyrocket in price. Products like pantry basics and tech must-haves that depend on are deeply tied to cross-border supply chains and are likely to face various kinds of disruptions

21 Products Canadians Should Stockpile Before Tariffs Hit