On the surface, trade issues between the United States and Canada may appear to be political disputes, but their effects extend well beyond formal discussions between governments. Investors of all sizes are feeling unexpected repercussions. This prolonged trade war subtly changes financial portfolios through increased consumer prices and stock market volatility.

The volatility of the stock market

Investors respond swiftly to increased trade tensions, frequently withdrawing funds from the market or moving to safer assets. Planning long-term investments becomes more difficult due to the erratic stock price fluctuations. Sudden declines can occur in even stable industries, causing investors to reconsider their approaches. You may already be aware of this rollercoaster impact if you own stocks.

The Canadian dollar is weaker.

Canada’s economy is weakened by trade wars, which frequently result in a decline in the value of the Canadian dollar. As a result, purchasing U.S. stocks and assets becomes more costly for Canadian investors. Conversely, Canadian exporters may benefit from a lower dollar, but American companies who sell to Canada may find it difficult as their goods become more expensive. Changes in exchange rates can present unforeseen difficulties for international investors.

Higher Goods Tariffs

Businesses that rely on imports and exports incur higher costs due to tariffs, which reduces their profit margins. These additional costs may be passed on to customers by businesses, which could reduce sales and negatively impact stock performance. You may see reduced profits if you own investments in businesses that depend on international trade. Additionally, higher tariffs may increase the instability of sectors like manufacturing and retail.

Growing Costs for Consumers

Businesses are forced to boost prices to offset costs as a result of higher tariffs. As a result, commonplace items like food, gadgets, and cars became more costly. Consumers cut back on spending as inflation increases, lowering business profitability and affecting investments in retail, hotel, and entertainment industries. Increased expenses may also result in lower business profits and a decline in stock values.

Disrupted Supply Chain

An integrated supply chain is created because many American and Canadian businesses depend on one another for parts and materials. Businesses must locate new suppliers, frequently at a higher cost, when trade barriers slow or stop shipments. Production efficiency and speed are impacted, which reduces business profits and deters investors from purchasing the company’s stock. These interruptions get greater the longer the trade war lasts.

Uncertainty in the Job Market

Trade restrictions may compel businesses to reduce employment, particularly in the auto, agricultural, and industrial sectors. Consumer spending declines when people lose employment, hurting companies in various industries. Job losses can slow the economy and reduce the performance of your portfolio if you own equities in retail, tourism, or real estate. Businesses are also wary due to the uncertainty.

Real Estate Market Fluctuations

Because fewer people can afford to buy homes, a faltering economy might drive down real estate prices. New dwelling constructions are also more costly due to rising building material costs brought on by tariffs. This rental and home sales slowdown may impact real estate investors and REITs (Real Estate Investment Trusts). A more serious slump in the housing market could result from an extended trade conflict.

The decline of Energy Stocks

Canada’s oil and gas sector relies heavily on American consumers, and trade disruptions impact energy equities. Stock prices in this industry may decline if the United States places tariffs on Canadian oil since it would decrease demand. Shareholders of energy companies may see lower dividends and worse long-term value.

Agricultural Struggles

Farmers in the United States and Canada depend on exports to sustain their operations. Farmers find it difficult to sell their crops and livestock when trade battles result in higher taxes on agricultural products. This creates financial instability for food processing businesses and agricultural stocks. This may decrease returns and fall stock prices for food business investors.

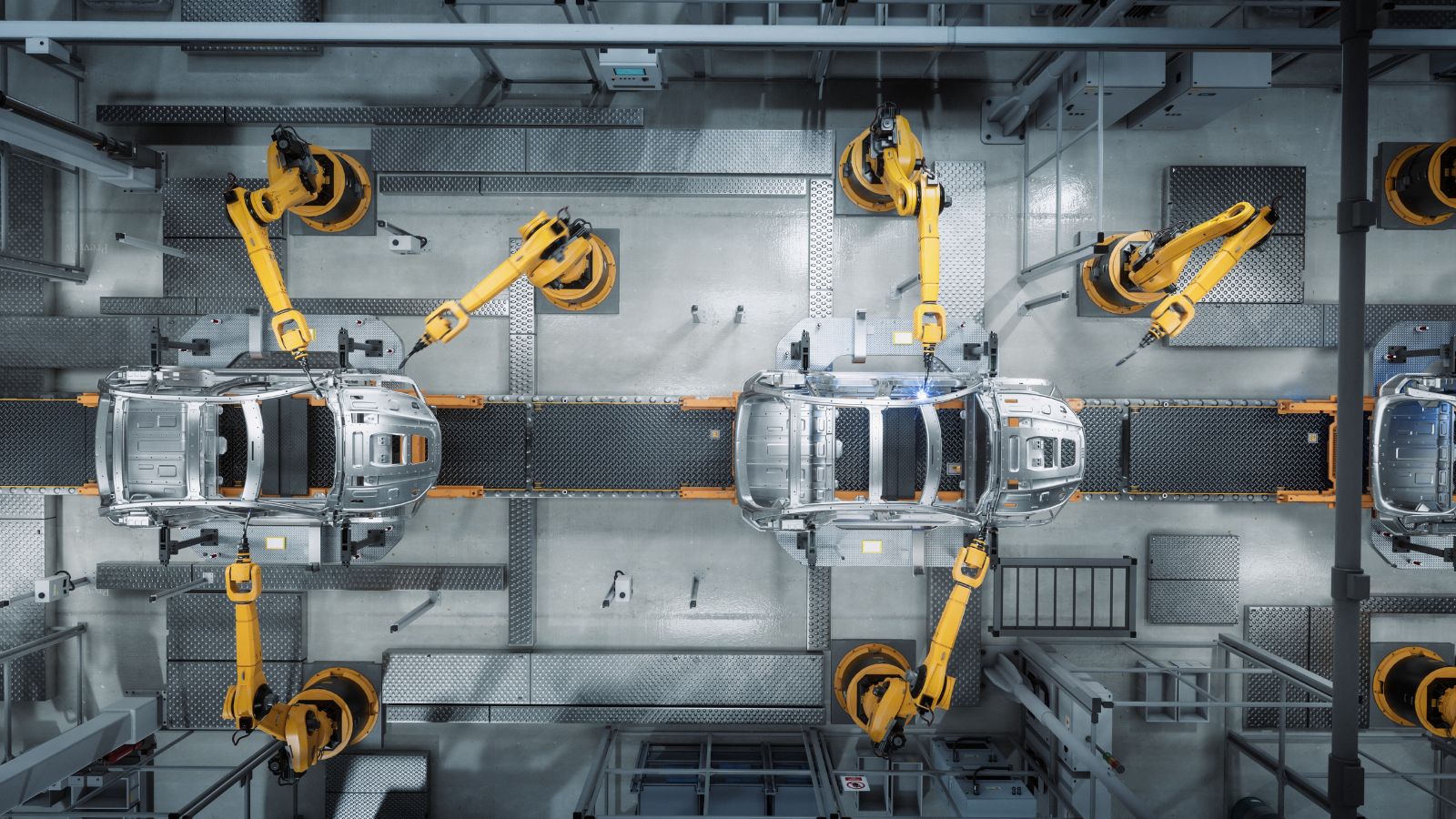

Automobile Industry Losses

With auto parts traveling across borders several times before a vehicle is finished, the auto industries in the United States and Canada are intricately linked. Trade restrictions raise the cost of production, which raises automobile prices and may result in job losses. Trade disputes may reduce the value of your portfolio if you own stock in automakers or auto component producers.

Drop in Customer Trust

People are more frugal with their spending when the economy is uncertain. Customers will make fewer large purchases if they are concerned about price increases or job security. This lowers the profits and stock values of retail, tourism, and entertainment companies. As consumer confidence declines, investors who own stock in these sectors may suffer a decline in returns.

A reduction in foreign investment

International investors keenly watch trade disputes, and instability may deter them from investing in North American economies. Stock prices and long-term company growth are impacted when foreign investment declines since it results in slower economic growth. Stock values may decline if fewer investors invest in the US and Canadian markets, which would affect the performance of your portfolio as a whole.

Risks in the Tech Sector

Access to international markets and efficient supply chains are essential to the tech sector. Major IT companies may be impacted by higher production costs caused by tariffs on electrical components. Trade disputes may impair the performance of businesses you own stock in, such as Apple, Microsoft, or semiconductor makers, and the value of your investment.

A rise in investments in gold and safe havens

Investors prefer gold and other safe-haven investments when the economy is shaky. This frequently raises the price of gold while decreasing the stability of conventional stock investments. Your long-term investing strategy may be impacted by changing markets if you haven’t diversified your holdings.

Changes in Currency Exchange Rates

A trade war impacts international investments since it alters the value of the US and Canadian currencies. Currency changes can alter the value of your assets if you have holdings in either country. This is particularly dangerous for investors with a large exposure to overseas stocks.

Interest rates and government debt

Governments may raise expenditures to stabilize the market if trade disputes impede economic growth. Increased debt levels may result from this, which may ultimately cause interest rates to rise. Bond investments, mortgages, and loans are all impacted by rising interest rates, which raise the cost of borrowing.

Developments in Retirement Savings

Strong stock market growth is essential for retirement plans such as RRSPs and 401(k)s. The long-term growth of retirement portfolios may be weakened if trade conflicts slow overall economic expansion. Investors who depend on these funds for the future might need to modify their approaches to reduce risks.

Excessive Market Reaction to Trade News

Prospects in Emerging Markets

Trade wars force companies to find new suppliers and markets, so not all effects are bad. Some businesses prosper in these shifting times, presenting fresh chances for investment. Investors who stay informed and adapt quickly can take advantage of these shifts for financial gain.

Conclusion

The U.S.-Canada trade war is impacting investments in unexpected ways. Knowledge is essential to safeguarding your financial future from fluctuations in the stock market, growing expenses, and economic unpredictability. Even though there are obstacles, diversity, and wise investing can help you get through these trying times.

25 Countries Predicted to Become Economic Superpowers in the Next 20 Years

The strength of an economy plays a crucial role in various international policies about trade and relations. Certain factors determine the strength of an economy, including population growth, availability of resources, and development and advancement. Here are 25 countries predicted to become economic superpowers in the next 20 years

25 Countries Predicted to Become Economic Superpowers in the Next 20 Years