The COVID-19 pandemic reshaped the global economy, creating unexpected winners and losers. In Canada, several businesses experienced unprecedented growth during the height of the crisis, fueled by lockdowns, shifting consumer habits, and increased demand for digital and home-based services. From tech startups to e-commerce platforms and delivery services, these companies thrived while others struggled to survive. However, as the world adjusted to post-pandemic realities, many of these once-booming businesses are now facing sharp declines, operational challenges, and even closures. This article explores 24 Canadian businesses that soared during COVID, but are now grappling with the difficult transition back to normalcy.

Well Health Technologies

Well Health Technologies became popular during the pandemic by buying clinics and offering virtual doctor visits. As people avoided hospitals, many turned to online health services. However, once the pandemic ended, most patients went back to in-person appointments. This caused a big drop in the company’s profits and share value, showing that its success didn’t last in the long term.

Lightspeed Commerce

From the onset of their entry into e-commerce, Lightspeed’s solutions have aided brick-and-mortar shops. However, the economic slowdown, inflation, and resumption of activity post-pandemic have tempered their growth. Significant stock price depreciation and changes within the management team pointed to unrest in the company.

Freshii

Freshii is a fast-casual food chain that tried to grow during the pandemic by selling grocery items in stores. Although it had some initial success, things fell apart afterward. Fewer customers returned after lockdowns, and many franchise owners were unhappy. The company also failed to clearly define its brand, which made it harder to attract loyal customers after COVID.

Shopify

Shopify became one of Canada’s biggest tech success stories during COVID, as small businesses rushed to open online stores. The company expanded quickly and hired thousands. However, this rapid growth wasn’t sustainable. When the economy slowed and demand dropped in 2022, Shopify had to lay off many workers. Its struggles showed that it grew too fast without preparing for the future.

KITS Eye Care

When shopfronts closed, the custom of buying eyewear online grew in popularity. KITS Eyecare capitalized on the buzz with a successful initial public offering (IPO). Facing growing competition and declining online customer interest, the company has seen its revenues shrink and its stock take a volatile turn.

Goodfood Market

Goodfood saw a huge rise in demand when people were stuck at home and wanted easy meal kits. The company spent a lot on advertising and expanding. However, once restaurants reopened and grocery prices soared, people stopped buying these kits. As a result, Goodfood had to cut jobs and reduce its business operations to survive.

Dialogue Health Technologies

Dialogue grew fast during the pandemic by offering virtual mental health support to employees. Many companies signed up to support their staff during stressful times. However, when employees returned to offices and more competitors entered the field, demand dropped. In 2023, the company reported growing financial losses, signaling trouble for its future.

BBTV (Broadband Television)

As consumers spent time in the isolation of their homes consuming content, the media platform and YouTube monetization tools offered by BBTV were thriving. However, once changes in viewing patterns commenced during the pandemic, the company found it difficult to keep pace and has now been confronted with decreasing revenues and questioning from investors.

Aritzia

When lockdowns came into effect, this fashion retailer did exceedingly well with online sales, especially among Generation Z. Nevertheless, supply chain issues, inflation, and quickly changing fashion trends caught up with them. The latest earnings report for the brand missed estimates, elevating investor concerns.

Sleep Country Canada

Mattress sales soared during 2020, as people invested time in their homes. Sleep Country took advantage of this trend. But with mortgage rates climbing and demand for home repairs dropping, sales slumped in 2023.

Peloton Canada (and associated vendors)

Although Peloton is not a Canadian company, many Canadian suppliers and retail partners benefited from its success during the pandemic. However, the demand for Peloton equipment is decreasing now, and there’s too much stock left. As a result, the Canadian businesses connected to Peloton are facing losses.

Canada Goose

Luxury outerwear outperformed expectations in terms of e-commerce sales in 2020 and 2021, but brand value began to decline owing to inflation and less discretionary expenditure. While Canada Goose is a lucrative brand, it confronts the problem of reinventing itself to adapt to the continuously changing market landscape.

Dye and Durham

During the pandemic, the legal tech company Dye & Durham grew quickly because of a rise in real estate deals and the shift to digital legal services. But later, interest rates dropped, the company took on more acquisitions, and its debt increased. This led to financial troubles, a slowdown in market activity, and eventually, employee layoffs.

MindBeacon

MindBeacon was incorporated into teletherapy in 2020 due to the benefits of COVID-19. Eventually, however, it was bought by CloudMD, another business operating in virtual health. Both companies then started to suffer from changes in the mental health industry regarding user retention and monetization in 2023.

Zoomer Media

ZoomerMedia focuses on serving Canada’s older population and gained popularity during the pandemic with content tailored to their needs. However, after COVID, fewer people stayed engaged, and the company started losing ground to digital-first competitors who are quickly attracting more of the audience with modern platforms.

Think Research Corporation

Think Research managed to grow during the pandemic by using digital healthcare tools and buying smaller companies. However, its fast expansion raised financial concerns. Now that the demand for telehealth is dropping, the company is also seeing a decline in its ability to make strong profits.

Reitmans

During the pandemic, the women’s fashion retailer Reitmans filed for bankruptcy protection but bounced back with a strong online presence. Despite this digital growth, foot traffic to physical stores didn’t meet expectations. Post-pandemic, changes in fashion trends and inflation made it harder for consumers to spend. As a result, in-store visits and overall sales struggled to return to pre-pandemic levels.

Mealshare

Since its inception, the Mealshare social enterprise has partnered with restaurants to donate one meal for every meal sold. Their work truly came alive during the COVID lockdown when people who were supporting these restaurants also sought to give back in a different way. However, while margins for restaurants have tightened, donations to Mealshare started to dwindle, forcing the organization to scale back its programs.

The LCBO (Liquor Control Board of Ontario)

The LCBO regulates the liquor industry in Ontario, preventing the government from running its own liquor stores. During the lockdowns, the LCBO saw a huge increase in alcohol sales. However, in 2023, as consumer behavior shifted toward health and wellness, their revenues dropped sharply, particularly from in-store sales, due to growing competition from online delivery services.

Corus Entertainment

During the pandemic, Corus Entertainment benefited from a captive audience as more people turned to television, resulting in higher ratings and increased ad revenue. However, post-pandemic, there’s been a rise in “cord-cutting” as viewers flock to streaming services. Traditional TV advertising is struggling, with more advertisers shifting their budgets to digital platforms. As a result, Corus is facing declining sales, narrower profit margins, and increasing pressure to adapt its business model.

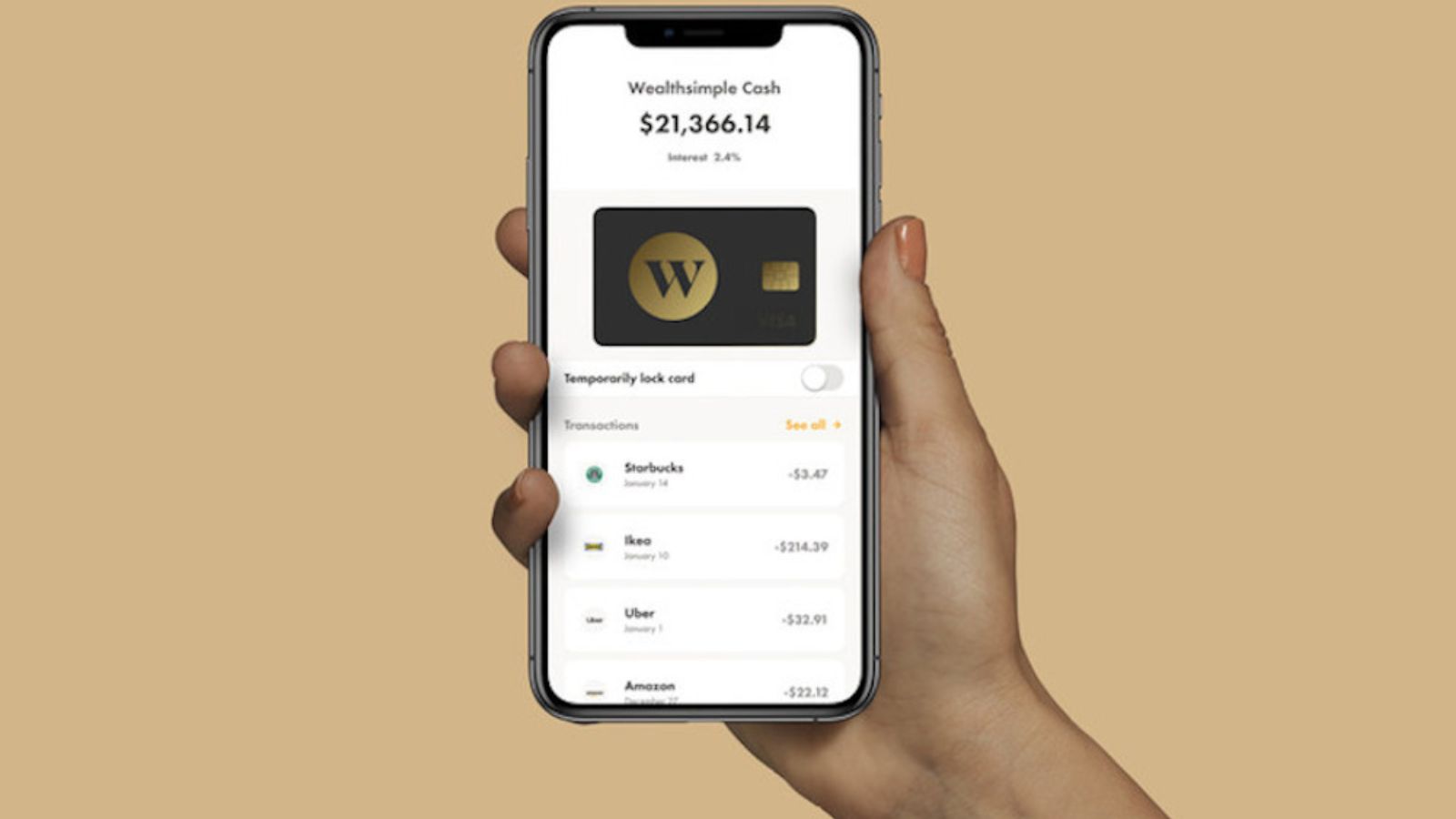

Wealthsimple

Many amateur investors and digital-first banking clients joined Wealthsimple during the COVID pandemic, capitalizing on the surge in interest. However, the crypto crash, market volatility, and a decline in consumer interest led to a drop in user activity. As a result, Wealthsimple faced layoffs in 2022 and 2023.

SkipTheDishes

SkipTheDishes was a leading food delivery app in Canada during the lockdowns. People ordered more, which helped the company grow. But now, it faces tough competition from global giants like Uber Eats and DoorDash.

Indigo Books and Music

Indigo saw a jump in book sales during the pandemic, as Canadians turned to reading for comfort. However, the company couldn’t adjust well after COVID. People shopped less in stores, and a serious ransomware attack in early 2023 damaged its website and sales. With strong competition from Amazon, Indigo lost money and customer trust.

Roots Canada

Roots is well-known for its premium loungewear and iconic Canadian logo. During the pandemic, the brand saw a boost in sales as people sought comfort and quality while staying at home. Sweatshirts, hoodies, and other home essentials saw increased demand. However, as restrictions eased, the demand shifted, and Roots struggled to maintain its momentum. The company now faces tough competition from global fashion giants that offer cheaper or more trendy alternatives.

Conclusion

The pandemic gave many Canadian businesses a rare chance to grow quickly, but that growth was often built on short-term demand rather than lasting strategies. As life returned to normal, consumer habits shifted, competition increased, and economic pressures exposed weak foundations. Companies that once thrived during lockdowns are now facing layoffs, shrinking profits, and even closure. Their stories remind us that success during a crisis doesn’t always mean long-term stability. In the end, businesses must adapt beyond the moment—those who plan for change and invest in resilience are the ones most likely to survive whatever comes next.

22 Times Canadian Ingenuity Left the U.S. in the Dust

When people think of innovation, they often picture Silicon Valley. However, Canada has a history of innovation, too. Whether it’s redefining sports, revolutionizing medicine, or just showing America up at its own game, Canadian inventors, thinkers, and dreamers have had their fair share of mic-drop moments. Here are 22 times Canadian ingenuity left the U.S. in the dust.

22 Times Canadian Ingenuity Left the U.S. in the Dust