When people compare Canada and the United States, attention usually goes to culture, politics, or weather. But what’s less talked about is how Canadians often manage to come out ahead financially, quietly and consistently. Despite earning less on average, Canadians tend to have fewer debts, more social protections, and surprising financial advantages. These are 25 reasons Canadians are quietly wealthier than Americans.

Universal Healthcare Means Fewer Medical Bills

One of the biggest financial wins in Canada is universal healthcare. Canadians don’t need to budget thousands every year for premiums, co-pays, or surprise medical bills. While Americans might go into debt over an emergency room visit, Canadians simply flash their health card. Over time, this saves Canadians tens of thousands of dollars, and gives peace of mind money can’t buy.

Lower College Tuition Costs

Canadian students graduate with significantly less debt compared to their American peers. With strong public universities and government subsidies, tuition remains far more affordable. Plus, the repayment plans are often more forgiving. It’s a long-term financial head start that makes a real difference by the time students hit their 30s.

No Need for Expensive Private Insurance

Americans often rely on employer-sponsored health insurance, which can be expensive or disappear with job loss. Canadians don’t have to worry about switching plans, losing coverage, or paying into high-deductible systems. This stability lets them build wealth with fewer interruptions, providing a quieter but consistent financial safety net.

Fewer Bankruptcy Filings Due to Medical Debt

Medical debt is a leading cause of bankruptcy in the U.S., but it’s almost unheard of in Canada. Since basic healthcare doesn’t come with an enormous price tag, people are less likely to fall into extreme financial hardship. That security allows Canadians to save, invest, or weather other challenges more easily.

Stronger Social Safety Nets

Canada’s programs like Employment Insurance (EI), paid parental leave, and child benefits offer real support in tough times. These aren’t just feel-good policies, they help people avoid financial ruin. They also reduce reliance on credit and payday loans, resulting in more stable household finances over a lifetime.

Lower Incarceration Rates Mean Fewer Family Disruptions

The U.S. incarceration rate is one of the highest in the world, and it often leads to financial collapse for families. Canada’s more rehabilitative system means fewer households experience that kind of disruption. That translates to better long-term financial health for communities and fewer missed work years and lost incomes.

Affordable Prescription Drugs

While the U.S. pays some of the highest prices in the world for medications, Canadian prices are regulated. Canadians don’t need to skip doses or ration meds to save money. That also helps prevent serious health issues down the line, which saves even more.

No Surprise Ambulance Bills

In Canada, calling an ambulance doesn’t come with a $2,000 bill. Americans sometimes hesitate to call 911 because of the cost. Canadians simply don’t have to budget for that, which removes a huge element of financial risk. It’s one of those invisible savings that adds up.

Slower Pace of Consumerism

Canadians tend to be less aggressive consumers than Americans. There’s less pressure to buy the newest car, the flashiest house, or the most expensive gadgets. That slower pace means less credit card debt and more financial breathing room and a more sustainable approach to spending.

More Walkable Cities and Public Transit

Canada invests more in public transit infrastructure, especially in big cities like Toronto, Vancouver, and Montreal. That allows more people to live without a car—or at least with fewer driving expenses. Americans often need multiple vehicles per household, which drains thousands annually, meaning Canadian urban living can be surprisingly cost-efficient.

Home Energy Efficiency Incentives

Canadians benefit from federal and provincial rebates that help them insulate homes, upgrade heating systems, or switch to energy-efficient appliances. That means lower utility bills and long-term savings. Americans may pay more just to heat and cool their homes and, while It’s not flashy, it builds financial comfort over time.

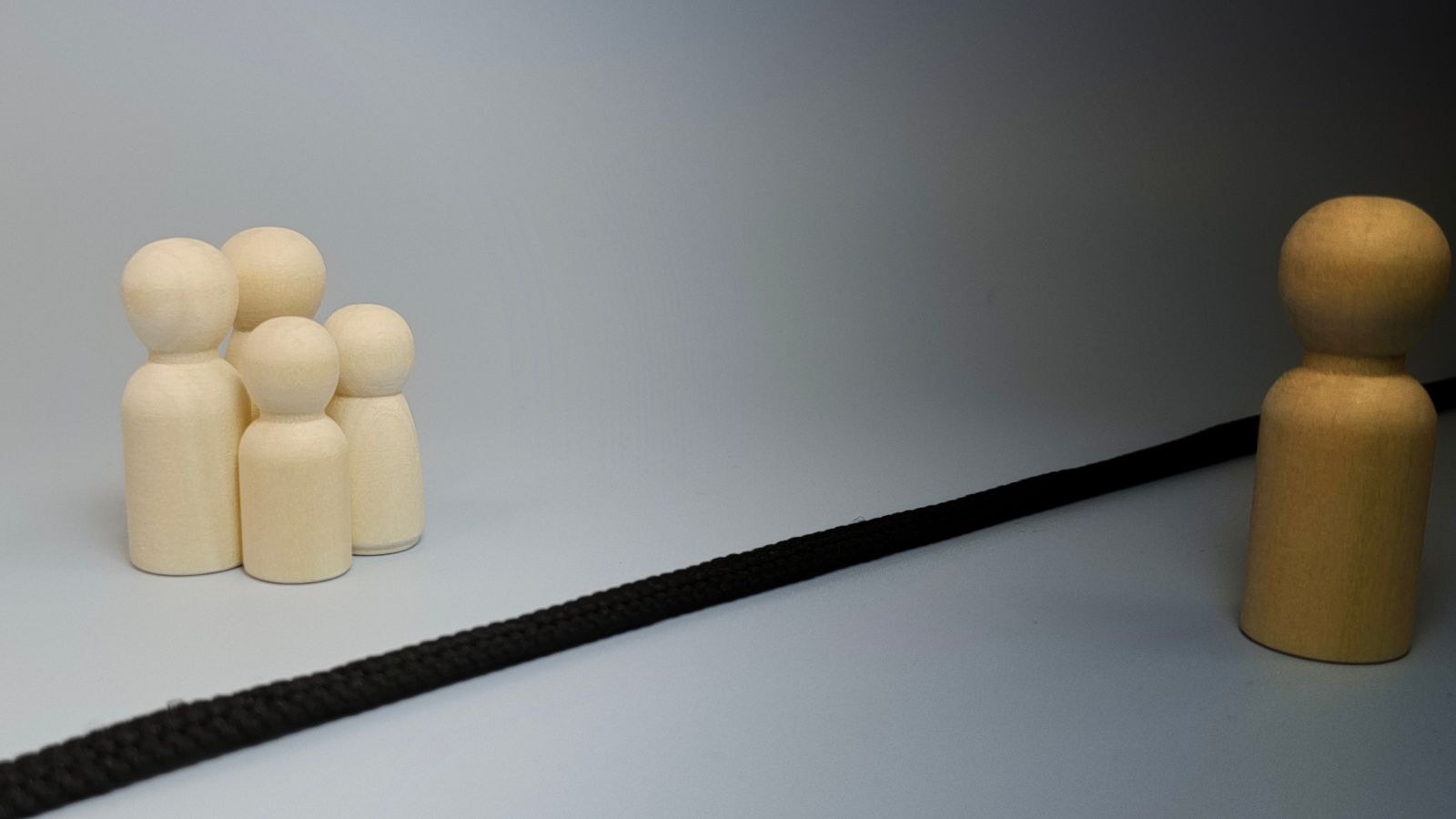

Less Extreme Wealth Inequality

While Canada isn’t perfect, its wealth gap isn’t as vast or visible as in the U.S. Middle-class Canadians often live more similarly to upper-middle-class ones, while in the U.S., the extremes are more pronounced. This stability contributes to healthier economies and less financial anxiety overall, creating a more level playing field.

Higher Median Credit Scores

Canadians generally carry less credit card debt and have higher average credit scores. That leads to better borrowing terms, lower interest payments, and smarter financial options. Over decades, that means serious savings on mortgages, car loans, and more.

Child Benefits That Actually Cover Costs

Canada’s Canada Child Benefit (CCB) gives direct monthly payments to parents, tax-free. For some families, it’s enough to pay for groceries, school supplies, or even rent. American parents often receive smaller, less consistent support, a steady help in freeing up money for savings or investments.

Mortgage Rules that Limit Risk

Canada’s tighter mortgage regulations protect homeowners from the kind of housing crashes seen in the U.S. Banks are more cautious, and down payments are usually higher. This discourages overborrowing and prevents many Canadians from being “house poor” and creates long-term, steadier financial growth.

Less Student Loan Interest

Canadian student loans often come with lower interest rates and better repayment terms. In many provinces, interest has been eliminated entirely. That means graduates pay down their loans faster, and have more disposable income sooner, which offers a significant financial edge over American grads.

Less Military Spending, More Social Investment

Canada spends far less on defense and more on public services. While Americans fund a massive military budget, Canadians enjoy things like better transit, education, and public healthcare. This balance supports citizens more directly and tangibly, creating a different kind of national wealth.

Shorter Commutes, Less Gas Money

Because Canadian cities tend to be more compact and transit-friendly, commutes are often shorter. That saves time and money on fuel, maintenance, and wear-and-tear. For many Americans, long daily drives are just part of life, and a constant financial drain. In Canada, commuting can be easier on both wallet and well-being.

Lower Infant Care Costs

Daycare in Canada is often subsidized or capped, especially in provinces like Quebec where fees are famously low. Compare that to thousands per month in many U.S. cities, and it’s clear Canadians come out ahead. Affordable childcare means parents can return to work sooner and save more, a major boost to household income.

More Paid Vacation Time

By law, Canadian workers get a minimum of two weeks paid vacation, more in many cases. In contrast, Americans aren’t guaranteed any paid time off. That means Canadians are less likely to burn out or lose income when they take a break, showing that quality of life is financial wealth, too.

Stronger Banking Regulations

Canada’s banking system is known for its stability. Strict regulations helped the country avoid much of the 2008 financial crisis fallout. That stability gives Canadians more confidence in their savings and investments, creating a secure financial system protects everyone’s wealth, whether they notice or not.

Lower Crime Rates Mean Lower Insurance Costs

Canada’s lower crime rates lead to lower premiums on everything from home to car insurance. That might not sound like much, but it adds up annually. Less risk means more money stays in your pocket and it’s one less stress to juggle.

Lower University Dropout Rates

Because of smaller class sizes, subsidized tuition, and more accessible professors, Canadian students are more likely to finish their degrees. Dropping out with debt and no diploma is a common American struggle. More degrees completed equals better job opportunities and higher lifetime earnings, which is long-term wealth in action.

Stronger Public Pension System

The Canada Pension Plan (CPP) provides a predictable and stable income for retirees. While it may not make anyone rich, it’s more reliable than many 401(k)s or privatized systems. Combined with Old Age Security, it keeps seniors out of poverty, reducing pressure on families and boosts intergenerational financial health.

Greater Focus on Saving than Spending

Canadians are generally more conservative with money, leaning toward saving and investing. Cultural attitudes favor caution over flash, which means fewer financial disasters. It’s a quiet strength, but one that pays off over a lifetime, showing that sometimes wealth is what you don’t spend.

22 Times Canadian Ingenuity Left the U.S. in the Dust

When people think of innovation, they often picture Silicon Valley. However, Canada has a history of innovation, too. Whether it’s redefining sports, revolutionizing medicine, or just showing America up at its own game, Canadian inventors, thinkers, and dreamers have had their fair share of mic-drop moments. Here are 22 times Canadian ingenuity left the U.S. in the dust.

22 Times Canadian Ingenuity Left the U.S. in the Dust