Aging gracefully involves more than just good genetics or positive thinking. Keeping yourself looking and feeling fresh requires thoughtful planning, consistent effort, and often, financial investment. While many find their golden years the best of their lives, we take a look at 18 truths about the financial and emotional costs of aging with dignity:

Healthcare Costs Increase with Age

As people age, the likelihood of needing medical care increases dramatically. From routine checkups to managing chronic conditions, such as arthritis and glaucoma, healthcare expenses account for a significant portion of a retiree’s budget, even with insurance or Medicare.

The Hidden Expense of Preventive Care

Staying healthy often involves more than regular doctor visits. Preventive measures such as fitness classes, nutritional supplements and specialized diets can be costly and aren’t covered by insurance, making them an out-of-pocket expense that many struggle to afford.

Long-Term Care Costs Are Often Overlooked

Many people underestimate or ignore the possibility of needing long-term care. Assisted living facilities, nursing homes, or in-home care services can cost thousands of dollars per month. These expenses can deplete savings quickly, especially if plans for long-term care insurance weren’t made early.

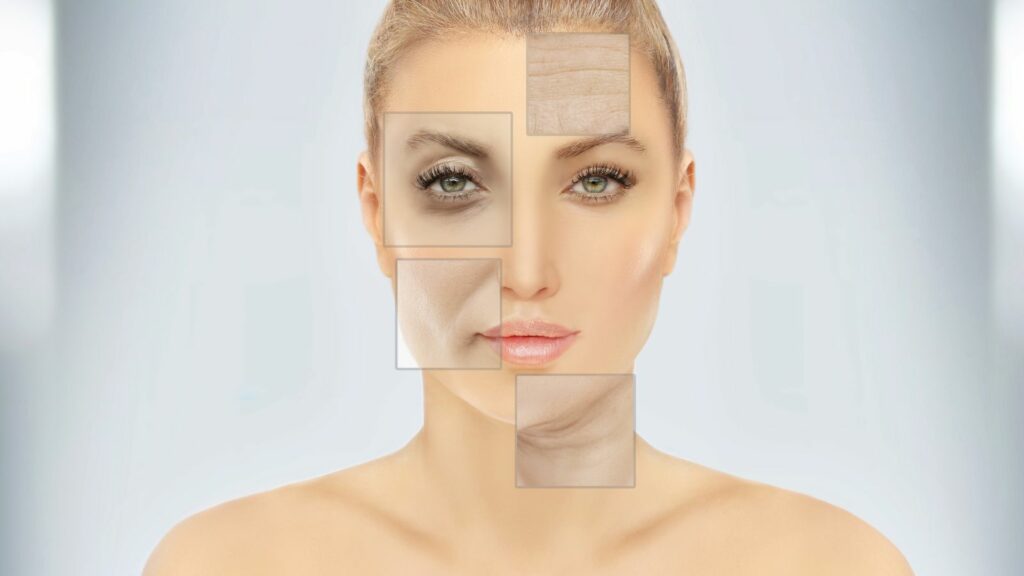

Cosmetic Procedures Are Expensive

For those who prioritize looking youthful, cosmetic treatments such as Botox, fillers or plastic surgery can become a considerable expense. Cosmetic procedures can boost confidence by making people appear younger but they often require ongoing maintenance, which is a long-term financial commitment.

Technology for Aging Assistance

Smart home devices, wearable health trackers and emergency alert systems can make life easier and safer for older adults. But, the cost of buying laptops and devices can be very expensive, especially when you add on internet fees and the cost of various subscriptions.

Prescription Medications Add Up

Aging gracefully often means managing chronic conditions, which frequently require medications. While insurance may cover some medical costs, copayments and uncovered drugs can lead to substantial expenses, especially if they require brand-name medications.

Dental Care Costs Rise with Age

Oral health needs change as we age, with many older adults requiring procedures like implants, dentures, or gum disease treatments. Unfortunately, dental care is often not included in health insurance plans, making it a costly but necessary aspect of aging gracefully.

Vision and Hearing Aids Aren’t Fully Covered

As vision and hearing decline, corrective measures like glasses, contact lenses, or hearing aids become essential. These devices, along with regular checkups and adjustments, can cost thousands of dollars over time and they are rarely covered comprehensively by insurance.

The Price of Senior-Friendly Housing

Many older adults choose to downsize or move to senior-friendly housing communities that offer accessibility and safety. But, retirement communities often come with higher upfront costs or ongoing fees for amenities, adding financial strain on retirees with fixed incomes.

Fitness and Mobility Maintenance

Maintaining mobility through exercise is key to aging gracefully. Memberships to gyms, yoga studios, or specialized classes for seniors are often necessary investments. Additionally, physical therapy or specialized equipment like walkers and braces may also be required, adding to the cost.

Social Engagement Isn’t Always Free

Staying socially active is crucial for mental health, but activities like group outings, club memberships or travel often come at a price. Social meet-ups enrich people’s lives and help prevent loneliness and isolation but they require budgeting to make sure they’re affordable.

The Cost of Loneliness

Feeling lonely is a common experience for many older people who miss being in the company of people at work. Keeping on top of loneliness often means paying for therapy sessions or companion services to combat isolation, which can take a toll financially.

Caregiving for Loved Ones

Many older adults find themselves caring for aging spouses, disabled children, or even grandchildren. The financial strain of caregiving, combined with the emotional demands, can be overwhelming and often impacts their ability to focus on their own needs.

The Price of Healthy Eating

Aging gracefully requires a nutritious diet, which can be more expensive than cheaper, processed alternatives. Organic produce, lean proteins and specialty items for dietary restrictions can lead to higher grocery bills, especially for those on a fixed income.

Travel and Leisure for Mental Health

Traveling to visit family, explore the world or enjoy a vacation is a common goal for many older adults. But, travel expenses such as flights, accommodations and insurance can strain retirement funds, even when people have planned for this in their retirement budget.

The Cost of Mental Health

Aging can bring many emotional challenges, from coping with the loss of significant people in your life to adjusting to retirement. Therapy or counseling can help maintain good mental health services but support services are expensive and not always covered by insurance.

The Rising Cost of Insurance

As people age, the cost of health, life and long-term care insurance tends to rise, with premiums becoming a significant expense for those who delayed purchasing policies earlier in life. Balancing the costs of living and saving for the future is often challenging and can put a strain on finances.

Planning for the Unexpected

Aging gracefully involves preparing for unforeseen events like medical emergencies, home repairs or sudden caregiving responsibilities. Creating an emergency fund can help with unexpected costs but not everyone has the budget to do so, meaning they are left with worrying bills that they cannot pay.

20 Reasons Why Wealthy Investors Are Looking At The Caribbean

The Caribbean has long been known for its stunning landscapes and vibrant culture, but in recent years, it has also become an attractive destination for wealthy investors. The region offers numerous financial, economic, and lifestyle advantages that appeal to high-net-worth individuals seeking opportunities. Here are 20 reasons why the Caribbean has captured the attention of the global investment community.

20 Reasons Why Wealthy Investors Are Looking At The Caribbean