Tariff hikes aren’t just numbers on a page or headlines in a business journal—they affect real people, families, and communities. When the United States suddenly imposes steep tariffs on Canadian goods, it can feel like the rug is being pulled out from under Canada’s economy. Even industries you might not immediately consider could be in serious trouble in a nation where over 75% of exports go to the U.S. Let’s take a closer, more personal look at 26 surprising Canadian industries that could struggle—or even collapse—if tariff hikes trigger a severe economic downturn.

Automotive Parts & Assembly

The automotive industry is a classic example of how intertwined our economies are. Many Canadian companies specialize in producing the tiny components that go into vehicles, and these parts often make multiple trips across the border during assembly. Imagine your neighbor’s small auto parts shop suddenly facing a 25% cost increase because every shipment now carries an extra fee. For many of these businesses—especially the smaller ones—this could mean staying afloat or closing shop.

Oil & Gas Extraction

Oil and gas extraction isn’t just about big oil rigs and multinational corporations; it’s also about the communities that depend on them. Canada supplies a significant portion of the crude oil used in U.S. refineries. But if tariffs reduce U.S. demand, many smaller oil producers might find themselves squeezed out of a market they rely on, leading to layoffs and economic uncertainty in regions that have long depended on this industry for their daily bread.

Steel Production

Steel is at the heart of Canada’s manufacturing and construction sectors. If tariffs force up the price of steel, every project—from bridges to buildings—could suffer. Small steel mills, which don’t have the economies of scale of their larger counterparts, might not survive a sudden cost spike. This isn’t just an abstract issue; it’s about workers who rely on a steady paycheck and families who depend on local jobs.

Aluminum Smelting

Aluminum smelters are crucial for everything from car manufacturing to home construction. U.S. tariffs on Canadian aluminum can make products more expensive and less competitive. This price hike might be too much for smaller smelters, potentially leading to plant closures and long-term job losses in communities that have built their identity around these industries.

Forestry & Softwood Lumber

Canada’s forests are one of its greatest natural treasures and a major economic resource. The softwood lumber industry, in particular, has had its share of trade disputes over the years. With new tariffs, even well-established sawmills could be forced to close. Think about the families whose livelihoods depend on these mills, the local businesses that serve them, and the communities that would feel the loss if the mills were to shut down.

Agriculture (Grains & Livestock)

For many Canadian farmers, the U.S. isn’t just a market—it’s a lifeline. Tariffs on grains, livestock, and other agricultural products mean that the carefully cultivated relationships these farmers have built over decades could quickly crumble. When prices rise, and U.S. buyers turn away in search of cheaper alternatives, even the hardiest farms might be forced to scale back or, in worst-case scenarios, close altogether.

Dairy Production

Canada’s dairy industry is known for its stability, partly thanks to strong domestic policies. But many dairy producers also sell to U.S. buyers. A sudden disruption in that market could lead to lower prices and lost revenue, putting pressure on smaller dairy farms that already operate on slim margins. It’s a stark reminder that even sectors thought to be insulated can’t escape the ripple effects of trade wars.

Seafood Processing

Canada’s seafood is renowned worldwide, from lobster shacks in Nova Scotia to salmon farms in British Columbia. But if tariffs push U.S. buyers to look elsewhere, seafood processors could see their volumes shrink dramatically. It’s not just about big processing plants—the impact could trickle down to fishermen and local communities whose cultures and economies are built around the sea.

Mining & Mineral Processing

Canada’s vast mineral resources—whether potash, uranium, or base metals—play a huge role in the global supply chain. However, many of these minerals are destined for the U.S. market. Tariffs that reduce U.S. demand can devastate smaller mining companies, leading to closures and job losses in mining towns where every resident feels the impact.

Chemical Manufacturing

Chemicals are the building blocks of countless products, from cleaning agents to industrial lubricants. Canadian chemical manufacturers often depend on importing raw materials from abroad. When tariffs increase these costs, even a slight squeeze on profit margins can force smaller companies into making hard choices—like cutting production or, worse, shutting down.

Plastics & Rubber Products

Think of all the everyday items made from plastics and rubber: packaging, household goods, automotive parts, and so much more. Many of these products are manufactured using materials that become more expensive when tariffs are imposed. Rising costs can quickly become unsustainable for small companies producing these essential goods, leading to business closures that ripple throughout the economy.

Aerospace Components

Canada has a strong aerospace sector, supplying high-tech parts that are critical to the production of aircraft. These components are not just products—they result from decades of expertise and innovation. Tariffs that drive up the cost of these parts can delay production schedules and increase costs for aircraft manufacturers. Smaller aerospace suppliers, without the cushion of deep financial reserves, could face the harsh reality of having to shut down their operations.

Medical Device Manufacturing

Imagine a company that designs innovative medical devices—tools that save lives and improve patient care. Many of these companies are small, focused, and highly innovative. However, if tariffs make it more expensive to produce or export these devices, it could reduce production. The result? Fewer available medical devices could impact patient care and the broader healthcare system.

Pharmaceutical Production

Similarly, pharmaceutical companies producing specialized drugs for niche markets might be caught in a tariff-induced squeeze. With high regulatory and production costs, even a small increase in expenses can tip the balance from profitability to loss. For patients who rely on these medications, the consequences are more than economic—they’re a matter of health.

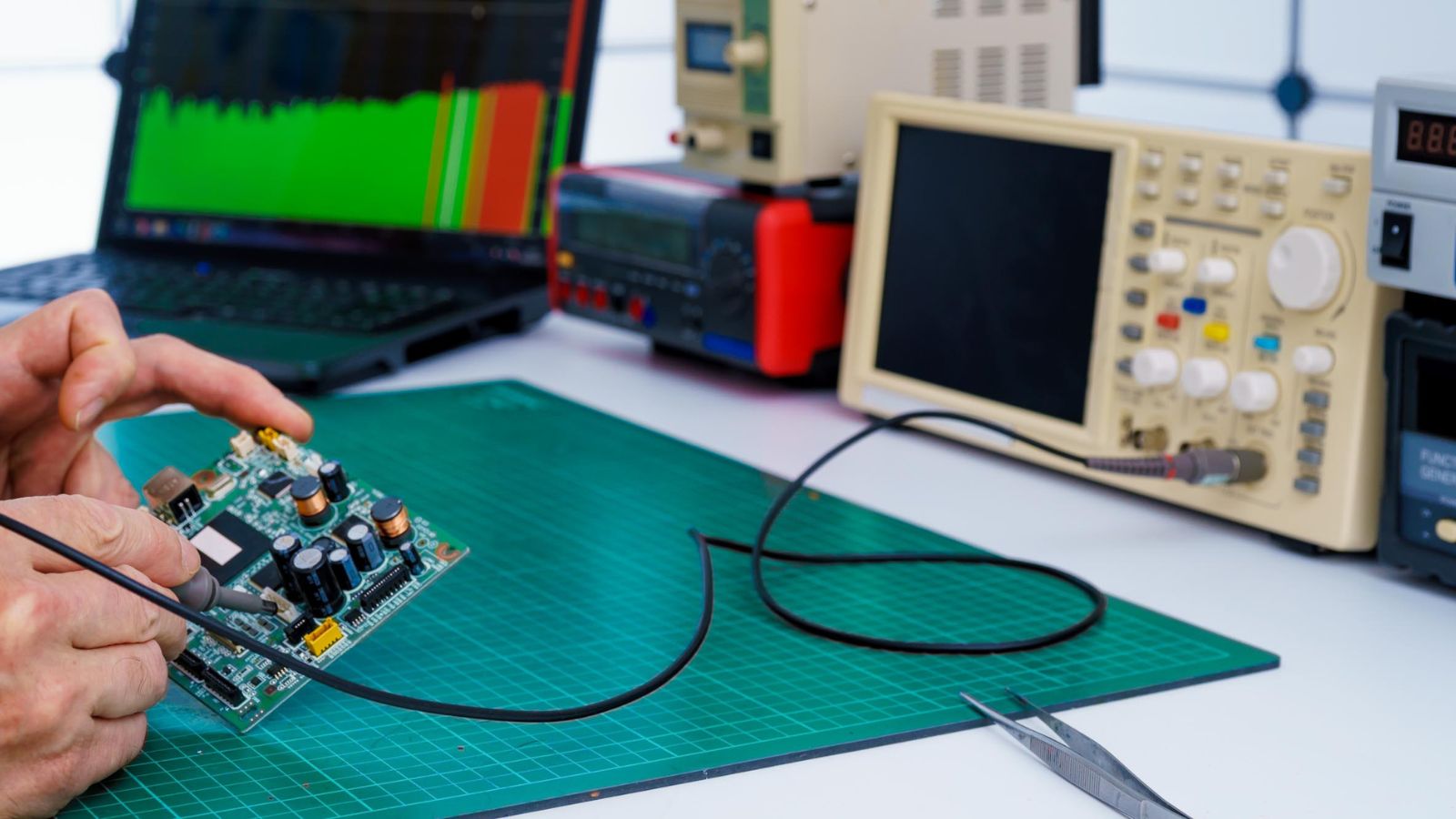

Consumer Electronics & IT Hardware

The consumer electronics sector is one of the most competitive industries globally. Canadian companies in this space often rely on components sourced from around the world. Tariffs that raise the cost of these components can lead to higher prices on the final products, making them less competitive. For smaller companies without the ability to absorb extra costs, this could mean the end of a promising business.

Furniture Production

There’s a certain charm to Canadian-made furniture—handcrafted, thoughtfully designed, and built to last. However, many furniture makers depend on a mix of domestic and imported materials. Tariffs on wood, metal, and textiles can quickly drive up production costs, forcing small-scale furniture producers to rethink their business models or face the possibility of closure.

Textiles & Apparel

For many independent designers and small clothing manufacturers, the textiles and apparel industry is all about creativity and passion. Yet it’s also an industry with very tight profit margins. Tariffs on imported fabrics and materials can have an outsized impact, pushing prices to levels that make Canadian-made clothing uncompetitive in the U.S. market. This isn’t just about fashion—it’s about preserving a vibrant part of Canada’s creative economy.

Craft Beer & Distilled Spirits

Canada’s craft beverage scene has exploded in popularity over the past decade, with local breweries and distilleries offering unique flavors that reflect regional identities. However, many of these craft producers rely on specialty ingredients from abroad. It might compel some cherished local businesses to cut back on production or shut down for good if tariffs increase the cost of those ingredients. For enthusiasts of craft beer and spirits, this loss extends beyond flavor—it influences community identity and local pride.

Wine Production

Small wineries across Canada, particularly in regions like Ontario and British Columbia, have built a reputation for quality. But when tariffs hit, even these niche producers aren’t immune. Higher export costs can tip the delicate balance for small vineyards, forcing them to lower production or exit the market. The winemakers and the communities that rally around their local wine culture would feel the impact.

Renewable Energy Equipment

Canada is investing heavily in renewable energy, with many companies producing solar panels, wind turbine components, and other green technologies. These industries depend on efficient global supply chains to keep costs low and maintain competitiveness. Tariffs on critical components could derail this progress, forcing smaller firms to struggle with higher production costs and potentially missing out on opportunities in the growing U.S. renewable energy market.

Telecommunications Equipment

Behind every smartphone and home internet connection is a network of intricate telecommunications equipment. Canadian companies in this sector produce advanced components that rely on international supply chains. Tariffs that increase the cost of key components can disrupt production and drive up costs, leaving smaller firms with little choice but to curtail operations or close altogether.

Food Processing & Packaged Goods

Food processing might sound like a straightforward industry. However, it’s an essential part of how raw agricultural products are turned into everyday items like packaged snacks and frozen dinners. Tariffs can raise the cost of raw ingredients and the final packaged products, making Canadian food processors less competitive in the U.S. market. These rising costs could be the nail in the coffin for many small food processing businesses.

Tourism & Hospitality

Even if you don’t think of tariffs when planning your next vacation, the hospitality industry is not immune. When tariffs lead to higher prices for consumer goods and disrupt supply chains, people have less disposable income to spend on travel and dining out. This reduction in spending can be particularly damaging for hotels, restaurants, and attractions in border regions, where tourism is a major economic driver.

Transportation & Logistics Services

The transportation sector is the unsung hero of international trade. Railroads, trucking companies, and shipping services are the arteries through which goods flow across borders. When tariffs slow down trade, these companies face reduced volumes and lower revenues. For smaller logistics providers, the ripple effect can be catastrophic—fewer jobs, less investment, and the risk of closure looms large.

Financial Services (Trade Finance)

Banks and financial institutions specializing in trade finance are essential for helping global trade operate effectively. If tariffs cause economic slowdowns, these institutions may see an increase in people unable to pay back loans and a decrease in available money to lend. Smaller banks and financial companies that depend largely on income from trade could feel significant pressure, which might put them in a difficult position. This could be a problem for those individual companies and the overall stability of the financial system.

Small Retailers Relying on U.S. Imports

Lastly, consider the small boutique or local retailer that relies on a steady stream of U.S.-made products. When tariffs drive up the cost of imported goods, these businesses face a tough choice: absorb the extra cost or pass it on to customers. Either way, their competitiveness takes a hit. With limited capital and thin profit margins, many small retailers may find themselves forced to close their doors, leaving a tangible gap in local communities and reducing consumer choice.

Conclusion

When discussing tariff increases and trade disputes, it’s easy to concentrate on the major sectors—the heavy industries such as oil, steel, and automotive production. However, the reality is that the repercussions extend much further into daily life. Nearly every sector is linked, from the small-town family-run auto parts store to the local craft brewery that serves as a hub for the community. At their core, tariffs are not merely economic instruments—they represent policy choices that influence real individuals.

Ultimately, these tariff hikes aren’t just a story about numbers or percentages. They’re a story about people—the workers in auto parts plants, the farmers in rural communities, the entrepreneurs in urban centers, and even the consumers who head to the grocery store each week. When policies threaten to disrupt the lives of millions, it’s a sign that something must change. And that change will require smart policymaking and a shared commitment to keeping the human element at the heart of economic decision-making.

22 Groceries to Grab Now—Before another Price Shock Hits Canada

Food prices in Canada have been steadily climbing, and another spike could make your grocery bill feel like a mortgage payment. According to Statistics Canada, food inflation remains about 3.7% higher than last year, with essentials like bread, dairy, and fresh produce leading the surge. Some items are expected to rise even further due to transportation costs, droughts, and import tariffs. Here are 22 groceries to grab now before another price shock hits Canada.

22 Groceries to Grab Now—Before another Price Shock Hits Canada