Across Canada, certain moves, from buying into the right sectors to spotting overlooked opportunities, have quietly made ordinary investors into wealth-builders. Whether it is betting on tech before it went mainstream or grabbing real estate before prices skyrocketed, Canadian investing plays have the potential to deliver big, with timing, research, and a little nerve. Here are 20 Canadian investing moves that paid off big:

Buying into Shopify Pre-IPO

Those who saw the potential in Shopify before it went public in 2015 reaped massive rewards. The Ottawa-based e-commerce platform grew into a global giant, with shares skyrocketing in the years following its debut. Early investors benefited from both the company’s rapid expansion and the pandemic-era online shopping boom. What seemed like a risky bet on a relatively unknown tech firm became one of Canada’s most celebrated stock market success stories. It was proof that backing homegrown innovation can pay off, and sometimes, the most significant wins come from companies in your backyard.

Riding the Canadian Housing Boom

Canadians who invested in real estate before the mid-2010s saw their property values soar. Cities like Vancouver, Toronto, and Ottawa experienced double-digit annual growth for years, creating significant equity gains for homeowners and investors alike. Even modest condos purchased a decade ago often doubled or tripled in value. While high prices now pose challenges for buyers, early investors in the boom turned real estate into one of the most reliable and lucrative long-term plays in Canadian history.

Betting on Canadian Banks During the 2008 Crisis

When global markets were in turmoil in 2008, some Canadians doubled down on domestic banks like RBC, TD, and Scotiabank. Thanks to Canada’s more conservative banking system, these institutions weathered the storm better than many international peers. Investors who bought shares during the downturn enjoyed years of steady dividend payouts and strong capital appreciation, offering a reminder that sometimes, sticking with stable, well-regulated national champions is the safest and most rewarding bet.

Getting in Early on the Potash Market

Investors who recognized the importance of potash, a key agricultural fertilizer, before global demand surged enjoyed remarkable gains. Saskatchewan-based Nutrien and its predecessor companies benefited from rising crop production needs worldwide. Early stakes in potash producers were a smart play on both resource security and agricultural trends. With global food demand unlikely to slow, the potash industry has remained a solid performer, rewarding those who got in before it became a buzzword on the commodities market.

Buying Canadian Pacific Railway Before the Resurgence

Once seen as an old-economy relic, Canadian Pacific Railway underwent a dramatic turnaround in the 2010s. New leadership, efficiency upgrades, and strategic acquisitions boosted profits and share prices, and investors who bought in before the transformation enjoyed exceptional returns as CP expanded its network and modernized operations. It was a textbook case of spotting value in a legacy industry poised for a comeback, and it proved that even 19th-century companies can deliver 21st-century growth.

Investing in the Pre-Legalization Cannabis Market

Before recreational cannabis became legal in 2018, early investors in Canadian producers like Canopy Growth and Aurora Cannabis saw their holdings explode in value. The hype around legalization sent stock prices soaring in the years leading up to the change, and while the market later cooled, those who timed their exit well locked in significant profits. This was a rare case where understanding regulatory shifts and public sentiment created a short-term gold rush for sharp investors.

Spotting the Rise of Renewable Energy

Canadians who invested in renewable energy companies early, from wind farm operators to solar panel manufacturers, have seen steady and often rapid gains. Firms like Northland Power and Brookfield Renewable Partners benefited from global shifts toward clean energy and supportive government policies. As the energy transition accelerates, early adopters have not only made solid returns but also contributed to a greener economy. For many, it was proof that environmental responsibility and financial growth can go hand-in-hand.

Buying Gold Before the 2020 Pandemic Surge

Gold has long been a safe-haven asset, but those who bought in just before the COVID-19 pandemic saw especially strong returns. As global uncertainty spiked, gold prices climbed to record highs, and Canadian mining companies, particularly those in gold-rich provinces like Ontario and Quebec, benefited from the surge. For investors, it was a timely reminder that in times of crisis, a well-timed allocation to precious metals can pay off handsomely.

Investing in Technology ETFs

Rather than picking individual tech stocks, many Canadians opted for technology-focused ETFs in the early 2010s. These funds captured the explosive growth of both Canadian and U.S. tech giants, providing diversification and impressive returns. With lower risk than betting on a single company, tech ETFs became a favourite for investors who wanted exposure to innovation without the volatility of single-stock plays, which proved to be one of the most consistently rewarding over the past decade.

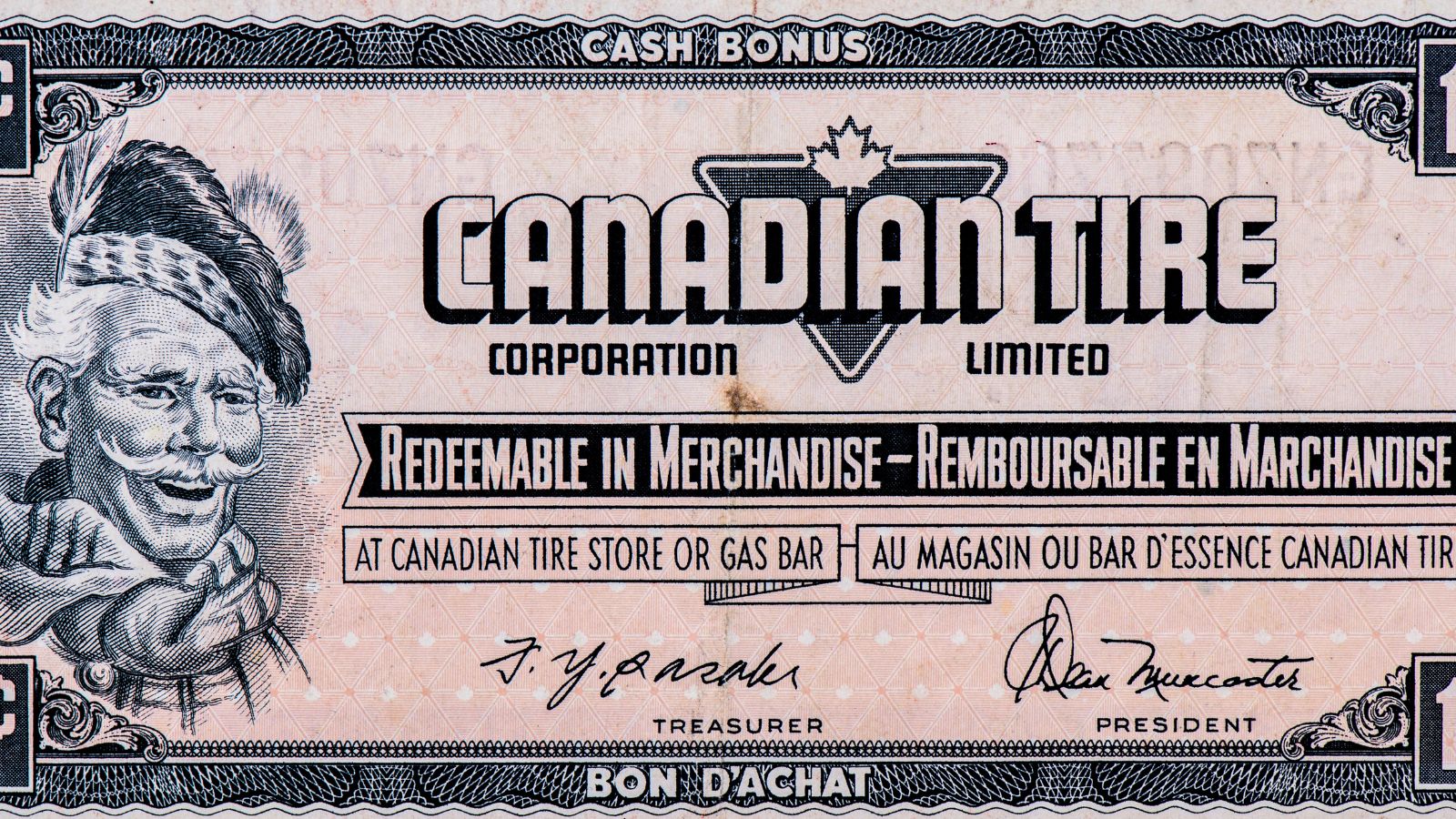

Buying Canadian Tire Stock in the Early 2000s

Canadian Tire may not have seemed like a flashy investment, but those who bought shares in the early 2000s saw remarkable long-term growth. The retailer expanded its footprint, modernized stores, and leveraged its iconic brand to stay competitive against international giants. Consistent dividends and capital appreciation rewarded loyal shareholders.

Getting in on the Toronto Condo Market Early

Investors who purchased pre-construction condos in Toronto before 2010 often saw staggering returns. With population growth, urbanization, and limited supply pushing prices higher, many units doubled or tripled in value before the keys were even handed over. At the same time, rental demand also surged, turning these properties into income-generating assets. Although entry prices are now sky-high, those early to the market benefited from years of appreciation, proving that timing in real estate can be just as important as location.

Buying Canadian National Railway Post-Privatization

When Canadian National Railway was privatized in the 1990s, few predicted the company would become one of North America’s most efficient rail operators. Early investors enjoyed decades of share price growth and consistent dividends, while CNR capitalized on cross-border trade, diversified freight services, and operational efficiencies to deliver steady returns. For those who spotted the opportunity early, it was a masterclass in how infrastructure investments can quietly outperform more glamorous sectors.

Investing in Brookfield Asset Management Early

Brookfield Asset Management’s rise into a global leader in real estate, renewable energy, and infrastructure created enormous wealth for long-term shareholders. Investors who bought in years ago saw steady gains as the company expanded internationally and diversified its portfolio. With a disciplined, value-oriented approach, Brookfield proved that patient capital and smart acquisitions can lead to extraordinary compounding over time. For many Canadians, it became the cornerstone of a retirement portfolio that outperformed expectations.

Buying into Canadian Oil Sands Before the 2000s Boom

Investors who recognized the long-term potential of Alberta’s oil sands before global energy prices spiked saw massive returns. Companies like Suncor and Canadian Natural Resources ramped up production, and soaring oil prices in the 2000s pushed profits and share prices higher. While the sector has faced volatility in recent years, those who timed their entry during the early development phase locked in decades of strong gains and generous dividends.

Getting Ahead of the Craft Beer Industry

While not a stock market play for most, Canadians who invested directly in small breweries during the early 2010s saw substantial returns as the craft beer boom took off. Many breweries expanded, sold to larger companies, or became highly profitable local brands, and early backers often gained not just financial rewards but also a share in a passionate, growing community. This move showed that niche consumer trends, when timed right, can become surprisingly lucrative.

Capitalizing on the Canadian REIT Boom

Real Estate Investment Trusts (REITs) offered Canadians a way to profit from commercial property without owning buildings directly. Investors who bought units in high-performing REITs in the early 2010s enjoyed strong dividends and capital growth as property values surged. With exposure to office towers, shopping centers, and industrial facilities, REITs proved to be a stable income source in a low-interest-rate environment.

Buying Fortis Shares for Dividend Growth

Fortis, a Newfoundland-based utility company, became a favourite for income investors thanks to decades of consecutive dividend increases. Those who bought in early enjoyed both share price appreciation and a reliable income stream. As the company expanded across North America, its reputation for stability and growth made it one of the most dependable performers on the TSX, providing a textbook example of how boring, essential services can quietly build wealth over time.

Getting in on the Lithium Boom Early

With electric vehicles on the rise, demand for lithium surged, and early investors in Canadian lithium mining companies scored big. Firms exploring deposits in Quebec and Ontario saw stock prices jump as global automakers raced to secure battery materials. While the sector remains volatile, those who entered before EV adoption went mainstream saw short-term windfalls and the potential for long-term gains.

Buying Dollarama Stock Before National Expansion

Dollarama’s transformation from a small chain into a nationwide retail giant created huge gains for early shareholders. The company’s focus on value-priced goods resonated with Canadians, especially during economic downturns, while expanding store counts and increasing product variety boosted profits year after year. Investors who recognized the growth potential in budget retail enjoyed consistent returns and market-beating performance.

Holding on to Enbridge for the Long Haul

Enbridge’s extensive pipeline network and steady cash flows made it a long-time favorite for dividend investors. Those who bought shares years ago benefited from both income and capital appreciation, as the company expanded its infrastructure and renewable energy projects. Even during volatile oil markets, Enbridge maintained payouts, rewarding patient investors who valued stability over short-term speculation.

21 Products Canadians Should Stockpile Before Tariffs Hit

If trade tensions escalate between Canada and the U.S., everyday essentials can suddenly disappear or skyrocket in price. Products like pantry basics and tech must-haves that depend on are deeply tied to cross-border supply chains and are likely to face various kinds of disruptions

21 Products Canadians Should Stockpile Before Tariffs Hit