Managing money in Canada today requires more than just a chequing account and a credit card. From tax shelters to budgeting apps, Canadians have access to an impressive toolbox designed to stretch every dollar, grow wealth, and protect against financial shocks. Yet many households underutilize these resources, leaving potential savings and investment growth on the table. Here are 22 financial tools every Canadian should be using:

Tax-Free Savings Account (TFSA)

The TFSA remains one of the most powerful tools for Canadians, yet many still overlook its full potential. Unlike traditional savings, investments inside a TFSA grow tax-free, whether they’re in stocks, ETFs, or high-interest savings accounts. Withdrawals are also tax-free, making it a flexible vehicle for both short-term and long-term goals. Annual contribution limits reset each year, with unused room carrying forward, giving consistent savers a major advantage.

Registered Retirement Savings Plan (RRSP)

The RRSP is Canada’s go-to retirement savings tool, offering tax-deferred growth and immediate tax deductions on contributions. While the money grows inside, investors don’t pay taxes until withdrawal, often at a lower rate in retirement, and it is particularly powerful for those in higher tax brackets, where deductions can be substantial. RRSPs can hold a wide range of investments, from bonds to equities, and even real estate investment trusts (REITs). Though withdrawals before retirement are taxable, programs like the Home Buyers’ Plan provide unique benefits that make the RRSP more versatile than most realize.

Registered Education Savings Plan (RESP)

For parents, the RESP is a must-have. Contributions grow tax-deferred, and the government sweetens the deal with the Canada Education Savings Grant, which adds up to 20% annually on contributions, to a certain limit. This is essentially free money toward your child’s education, and funds can be invested in stocks, mutual funds, or ETFs, compounding over time. Withdrawals are taxable in the student’s hands, usually at a lower rate, making this one of the most efficient ways to save for post-secondary costs. Skipping an RESP often means leaving government incentives untouched, a costly mistake for families.

High-Interest Savings Accounts (HISAs)

Not all savings accounts are created equal, and HISAs stand out as a simple but crucial financial tool. With interest rates consistently higher than those of standard accounts, HISAs are ideal for emergency funds, short-term goals, or parking cash between investments. Most accounts are insured by the Canada Deposit Insurance Corporation (CDIC), adding security to liquidity. The beauty of HISAs is accessibility, as you can withdraw funds whenever needed without penalties. For Canadians hesitant about risk, they offer a haven that keeps money working harder than it would in a traditional account.

Guaranteed Investment Certificates (GICs)

GICs provide Canadians with a reliable, low-risk option for fixed returns. When you purchase a GIC, you commit money for a set term, ranging from months to years, and in return, earn a guaranteed interest rate. While returns may not rival equities, the security is unmatched, especially with CDIC coverage, which is particularly valuable in uncertain markets, giving peace of mind while still delivering predictable growth. For conservative investors or retirees seeking stability, GICs balance a portfolio by reducing volatility.

Robo-Advisors

Robo-advisors like Wealthsimple and Questwealth have democratized investing for Canadians. These platforms use algorithms to build diversified portfolios tailored to your risk tolerance, all at a fraction of the cost of traditional financial advisors. Fees are low, usually around 0.4-0.6%, compared to mutual funds with MERs over 2%, and most also offer automatic rebalancing, tax-loss harvesting, and access to TFSAs and RRSPs. For Canadians who don’t want to manage investments actively but still want exposure to the markets, robo-advisors provide an easy, accessible entry point that can rival more expensive strategies.

Discount Brokerage Accounts

For Canadians who prefer hands-on investing, discount brokerage platforms like Questrade and TD Direct Investing are indispensable. They allow investors to trade stocks, ETFs, and other securities with minimal commission fees, often providing free ETF purchases. Unlike robo-advisors, these accounts give complete control, ideal for those who want to research, analyze, and execute trades themselves. Many platforms also offer advanced tools, real-time data, and even educational resources. For DIY investors, discount brokerages combine flexibility and low costs, giving Canadians a chance to grow wealth without relying on expensive mutual funds.

Exchange-Traded Funds (ETFs)

ETFs have surged in popularity for good reason, as they are low-cost, diversified, and widely available to Canadian investors. These funds pool money to buy a basket of assets, tracking indices like the TSX or S&P 500. With management fees often below 0.2%, ETFs provide broad exposure at a fraction of the cost of mutual funds, and they can be held in TFSAs, RRSPs, or even taxable accounts. Whether you’re targeting Canadian dividends, global equities, or bonds, ETFs offer flexibility and scalability, making them a cornerstone of any modern investment portfolio.

Dividend Reinvestment Plans (DRIPs)

DRIPs let investors automatically reinvest dividends from Canadian stocks or ETFs back into more shares, often commission-free. This compounding strategy accelerates portfolio growth over time without the hassle of manual reinvestment. Many Canadian blue-chip companies, from banks to utilities, offer DRIPs, giving investors access to steady, long-term growth opportunities, and the real value lies in consistency, where small dividend payments snowball into larger holdings, amplifying returns. For Canadians aiming to build wealth passively, DRIPs are a simple yet powerful tool that takes advantage of compounding in one of its purest forms.

Budgeting Apps

Budgeting apps like Mint, YNAB (You Need a Budget), and Canadian-focused options such as KOHO have transformed how households track money. These apps link directly to bank accounts and credit cards, categorizing spending automatically, and by offering insights into patterns, they help identify areas for savings and keep users accountable to goals. Many also include bill reminders, credit score tracking, and cash-flow projections. In a country where cost-of-living pressures are rising, budgeting apps offer an accessible way for Canadians to regain control and ensure every dollar is allocated wisely.

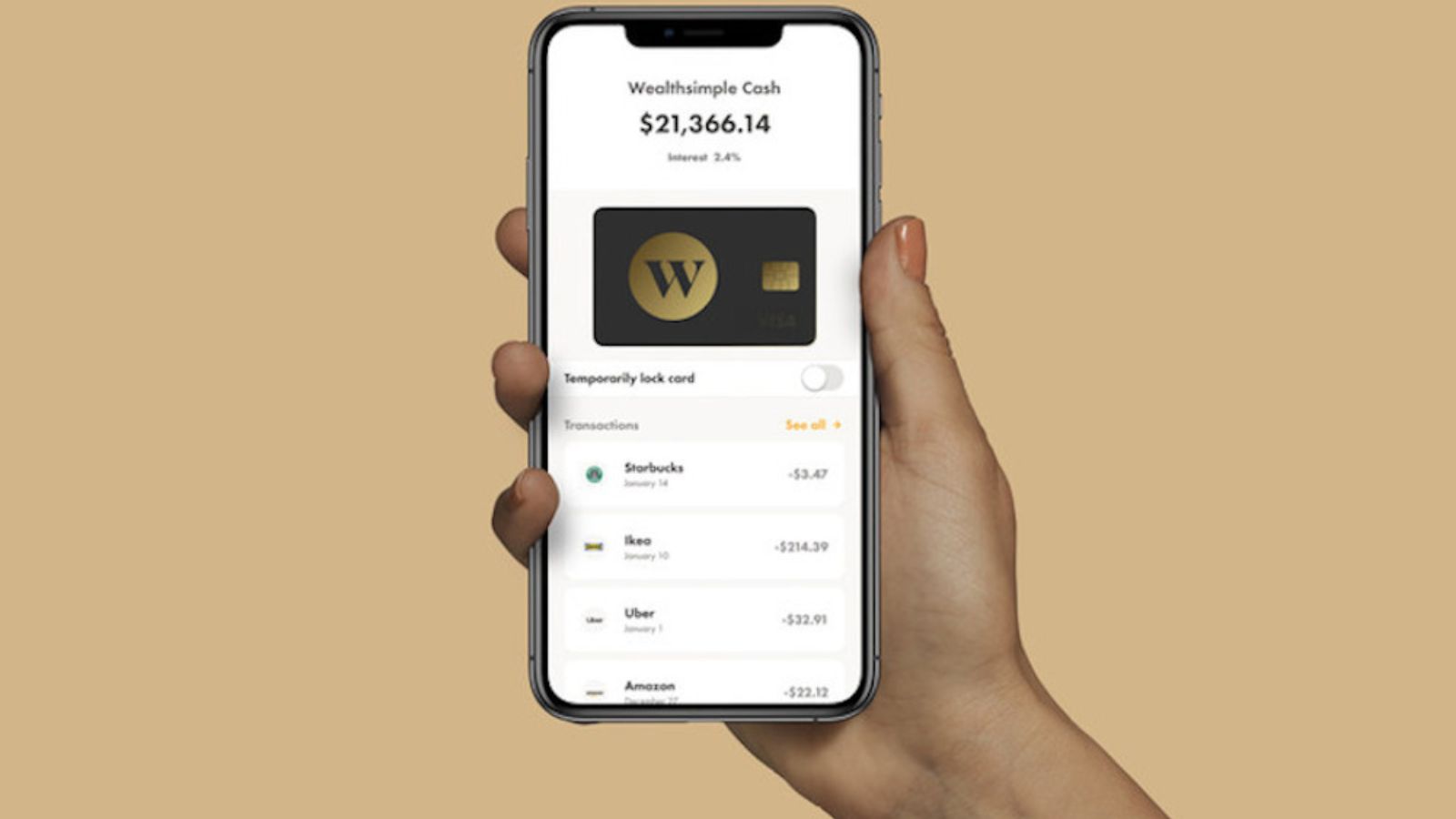

Prepaid Credit Cards

Prepaid cards like KOHO or Wealthsimple Cash are convenient and a smart budgeting tool. Since you can only spend what’s loaded, they help avoid debt while still offering perks like cashback and online purchasing. For younger Canadians or those rebuilding credit, prepaid cards provide financial flexibility without the risk of overspending, while many also integrate with apps to track spending in real-time. With features that mimic traditional credit cards but without the threat of accumulating interest, prepaid options give Canadians an extra layer of control over everyday expenses.

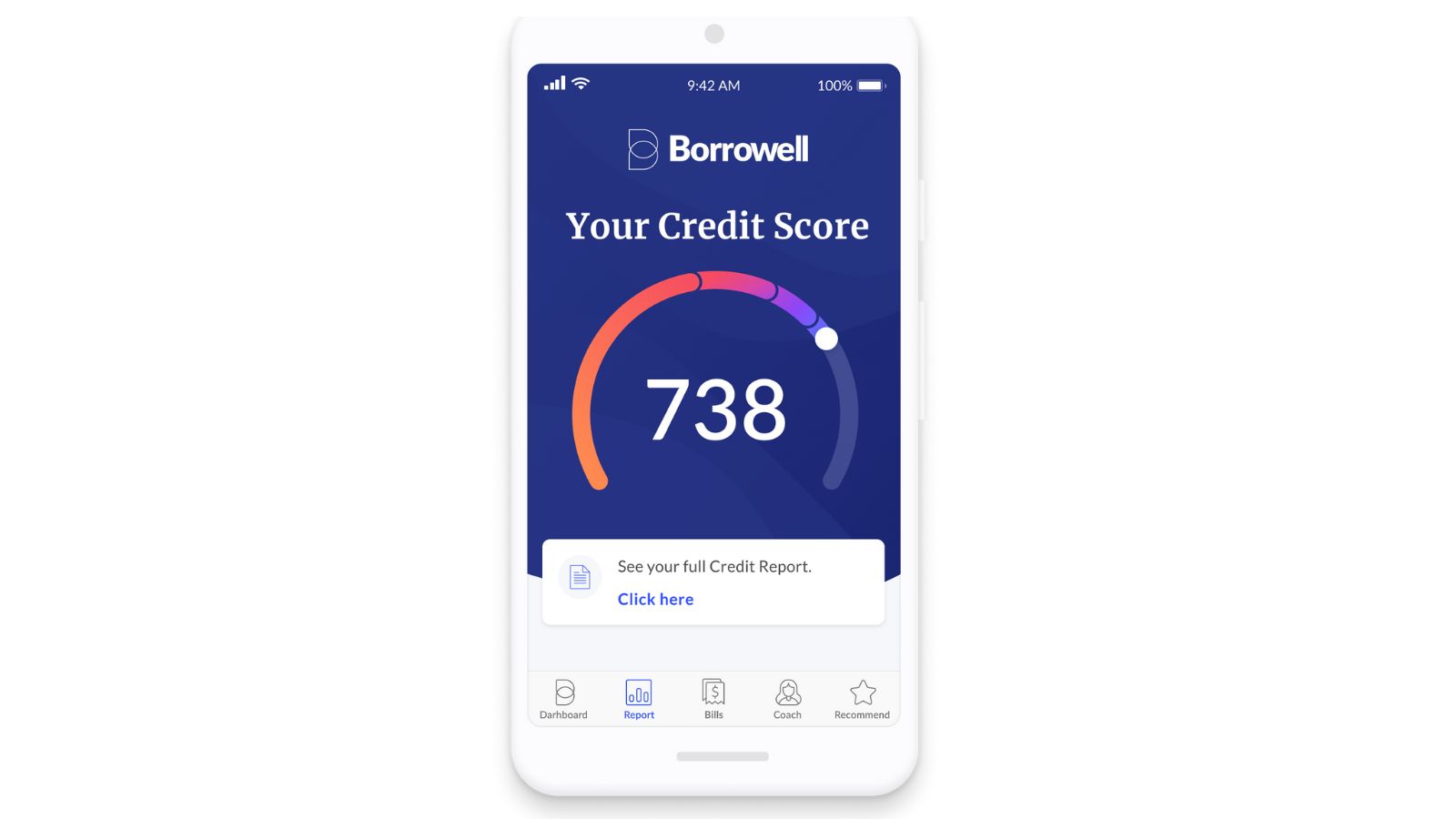

Credit Monitoring Services

Maintaining a healthy credit score is critical for everything from mortgage approvals to rental applications. Tools like Borrowell and Credit Karma provide Canadians with free access to their credit scores and reports, updated regularly. They also offer personalized financial recommendations, from lower-interest credit cards to debt repayment strategies. By monitoring your credit, you can spot errors, prevent fraud, and track progress as you build financial strength. Considering how many Canadians overlook their credit health, these services play an invaluable role in empowering households to make informed financial decisions.

Online Bill Payment Platforms

Platforms like Paytm Canada allow Canadians to pay bills directly using credit cards, debit cards, or linked bank accounts, sometimes even earning rewards in the process. This not only simplifies financial management but can also unlock cashback or travel points on everyday expenses. With reminders, automatic scheduling, and secure digital processing, these platforms reduce late fees and streamline household cash flow. In a digital-first era, paper cheques and manual bill payments feel outdated. Online bill payment tools are essential for efficiency and for maximizing the benefits of reward programs.

Cashback and Rewards Apps

Apps like Rakuten, Ampli, and Drop let Canadians earn cashback or points for everyday purchases. Whether shopping online or in-store, these tools help stretch household budgets by rewarding spending you’re already doing. Rakuten, for instance, offers cashback at hundreds of retailers, while Drop integrates with debit and credit cards to provide seamless rewards. Over time, these savings add up significantly. While not a substitute for investing or saving, cashback and rewards apps represent an easy win for Canadians looking to optimize daily spending without any added risk.

Debt Repayment Calculators

Managing debt without a plan can be overwhelming, which is why repayment calculators are such a valuable tool. Many Canadian banks and independent financial sites offer calculators that show how extra payments reduce interest and shorten timelines. Whether you’re tackling credit cards, student loans, or mortgages, these calculators provide a visual roadmap to debt freedom. They help users compare strategies, like the avalanche versus snowball method, and make smarter repayment decisions. By turning abstract numbers into clear strategies, repayment calculators empower Canadians to take control of financial burdens.

Emergency Fund Accounts

An emergency fund is less about returns and more about resilience. Dedicated accounts, often kept in HISAs, provide a financial buffer against job loss, medical expenses, or unexpected repairs. Experts recommend three to six months of expenses, but even a smaller cushion offers peace of mind. Many Canadians mistakenly rely on credit cards during emergencies, which can spiral into debt. Having funds set aside in a separate, easily accessible account ensures stability when life throws surprises, making it a foundational financial tool no household should be without.

Retirement Income Calculators

Retirement income calculators, often available through Canadian banks and government websites, help individuals project how much they’ll need and whether current savings are on track. By inputting data like age, savings, contributions, and expected expenses, these tools give realistic forecasts of retirement readiness. They can highlight funding gaps, prompting earlier adjustments in saving or investment strategies. With Canadians living longer and relying less on employer pensions, retirement calculators provide clarity in a landscape where uncertainty is high.

Life and Disability Insurance Tools

Insurance calculators and comparison platforms allow Canadians to assess coverage needs and find affordable options. From protecting families against income loss to ensuring mortgages can be paid in emergencies, life and disability insurance tools provide peace of mind. Many services also offer side-by-side quotes, helping consumers choose coverage that fits budgets and priorities. Given that financial shocks can derail decades of careful planning, these tools ensure Canadians aren’t left vulnerable. While often overlooked, insurance calculators and platforms are crucial for long-term financial stability.

Tax Preparation Software

Programs like TurboTax, UFile, and Wealthsimple Tax have simplified filing for millions of Canadians. These platforms guide users through deductions, credits, and income reporting while minimizing costly errors, and many also include audit protection and CRA integration, making filing efficient and stress-free. With tax rules constantly changing, reliable software helps Canadians maximize refunds or minimize liabilities without needing expensive accountants. Even for straightforward returns, the convenience and accuracy make tax prep software a financial essential that saves both money and hours of frustration each spring.

Currency Conversion Apps

For Canadians dealing with cross-border shopping, travel, or international investing, currency apps like XE or Wise are indispensable. These platforms provide real-time exchange rates, fee transparency, and often cheaper transfers than banks. With the Canadian dollar fluctuating against the U.S. dollar and other currencies, staying informed help households make smarter purchasing and investment decisions. Wise, for instance, allows low-cost international money transfers that beat traditional bank rates.

Personal Finance Trackers

Personal finance platforms like Quicken and PocketSmith provide Canadians with a big-picture view of their entire financial lives. By consolidating accounts, tracking spending, and forecasting net worth growth, they create a detailed map of financial progress. These trackers often include debt analysis, budget creation, and retirement projections in one package, making them more comprehensive than simple budgeting apps. For Canadians juggling multiple income streams, loans, and investments, they offer clarity and accountability, and with financial complexity rising, these tools are invaluable for staying on track toward long-term goals.

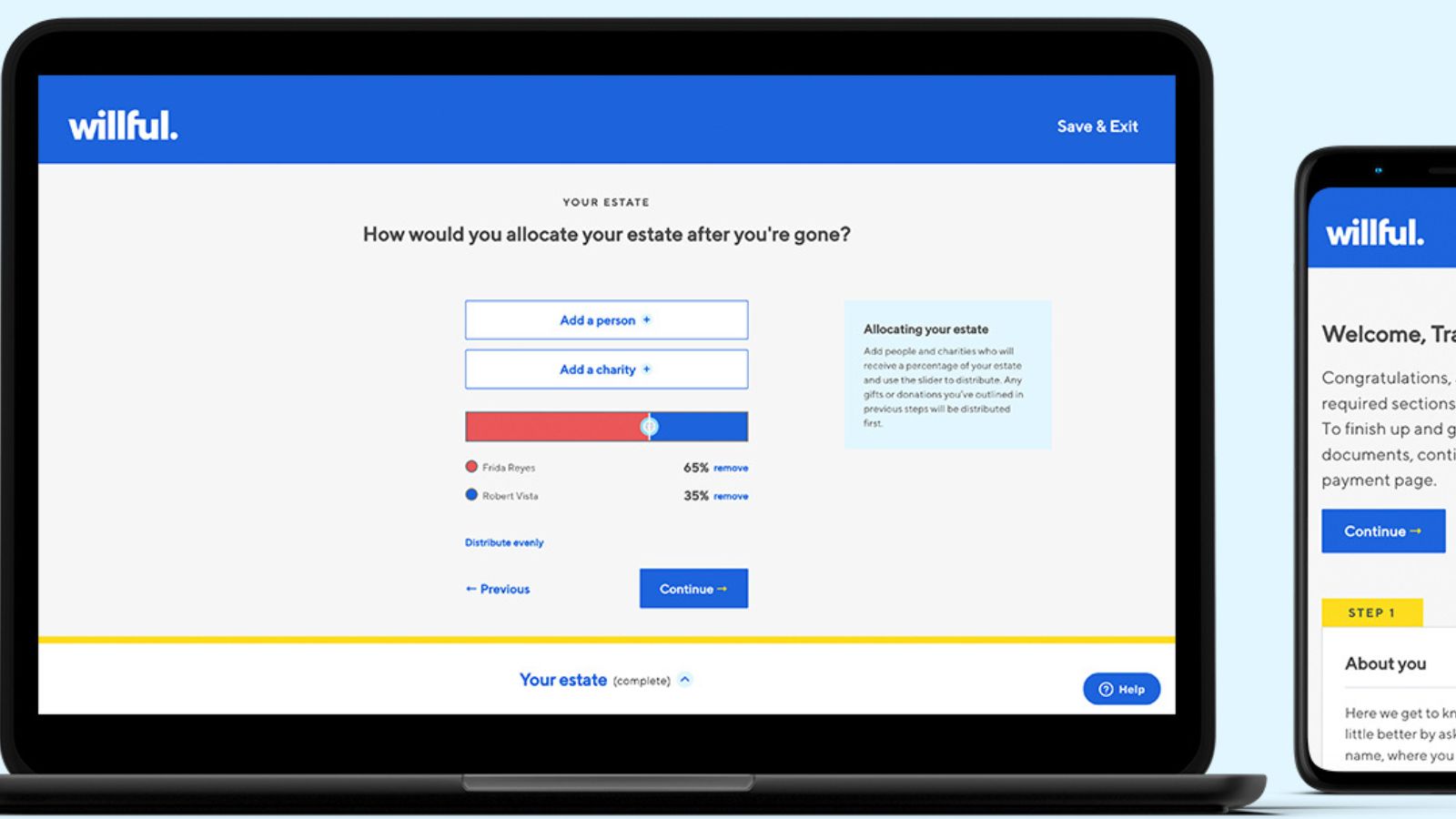

Estate Planning Tools

Estate planning software and will-creation platforms, such as Willful and LegalWills.ca, ensure Canadians prepare for the inevitable. These tools simplify creating legally valid wills, powers of attorney, and even digital asset management. By making estate planning affordable and accessible, they help families avoid costly legal disputes and ensure assets are distributed according to wishes. Considering how many Canadians die without a will, leaving their estates tangled, these platforms are essential for protecting both wealth and loved ones.

21 Products Canadians Should Stockpile Before Tariffs Hit

If trade tensions escalate between Canada and the U.S., everyday essentials can suddenly disappear or skyrocket in price. Products like pantry basics and tech must-haves that depend on are deeply tied to cross-border supply chains and are likely to face various kinds of disruptions

21 Products Canadians Should Stockpile Before Tariffs Hit