Housing costs across Canada continue to rise, but some towns still offer a realistic path to homeownership. These communities provide lower purchase prices, manageable living expenses, and stable local economies that support long-term affordability. Many attract families, retirees, and remote workers who want space without high costs. These towns also offer growing amenities, decent job opportunities, and a strong quality of life. Here are 20 Canadian cities where housing is still almost affordable.

Moncton, New Brunswick

Moncton remains one of Canada’s most affordable cities, offering lower home prices compared to major urban centres. The local economy is growing steadily with strong sectors like transportation, education, and healthcare. Many families and newcomers choose Moncton for its balance of affordability and quality of life. Detached homes and townhouses are still within reach for first-time buyers. The city also has a stable rental market with reasonable rates. With ongoing development and expanding job opportunities, Moncton continues to attract residents looking for affordable living without sacrificing amenities or community services.

Saint John, New Brunswick

Saint John offers some of the lowest home prices in Canada, making it a major destination for budget-conscious buyers. The city features a mix of historic homes and newer builds at prices far below the national average. Local industries like shipping, manufacturing, and energy support a stable job market. While property taxes can be higher compared to other regions, overall affordability remains strong. Residents enjoy oceanfront scenery, cultural attractions, and a slower pace of life. Saint John’s affordability makes it a standout option for buyers seeking value and long-term stability.

Fredericton, New Brunswick

Fredericton combines affordability with a vibrant community anchored by education and government sectors. Home prices are more reasonable compared to major Canadian cities, making it attractive for young families and professionals. The city offers a strong arts scene, outdoor activities, and well-rated schools. Its rental market is also relatively affordable, despite growing demand from students and newcomers. Many choose Fredericton for its balance of calm living and urban convenience. The city’s affordability and stable growth make it a strong choice for those seeking value and livability.

Charlottetown, Prince Edward Island

Charlottetown provides a unique blend of affordability and coastal charm. Home prices remain accessible, especially compared to larger provinces. The city’s economy benefits from tourism, agriculture, and education, creating steady employment opportunities. While prices have risen in recent years, they are still within reach for many buyers. The community atmosphere, clean environment, and strong cultural identity make Charlottetown appealing. Residents enjoy walkable neighbourhoods and a slower pace of life. Its affordability continues to attract families and remote workers looking for more space and a better quality of life.

Summerside, Prince Edward Island

Summerside is one of PEI’s most affordable towns, offering lower housing prices and a quiet lifestyle. The town provides a range of housing options, from older homes to newer developments. Local industries like aerospace, agriculture, and tourism support a stable economic base. Residents enjoy coastal living, recreational spaces, and close-knit community connections. Summerside’s affordability helps attract retirees, families, and individuals seeking lower living costs. With steady growth and improving amenities, it remains an excellent choice for buyers seeking value on the island.

Windsor, Ontario

Windsor remains one of Ontario’s most affordable cities, even as housing prices rise across the province. The city benefits from a strong automotive sector and proximity to the US border, creating diverse job opportunities. Home prices are considerably lower than in Toronto or Ottawa, making Windsor attractive for first-time buyers and families. The city offers a mix of suburban neighborhoods and revitalizing downtown areas. Rental prices are also more manageable than in many Ontario markets. Windsor’s affordability, combined with ongoing economic development, continues to draw new residents seeking attainable homeownership.

Sarnia, Ontario

Sarnia remains one of the more affordable housing markets in Ontario. Home prices stay well below provincial averages, which helps first-time buyers who feel priced out of larger cities. Local incomes align reasonably with property values, keeping ownership accessible. The city offers stable employment in manufacturing, energy, and chemical industries, supporting predictable demand. Sarnia also has lower property taxes compared to bigger urban centres. Its quiet neighbourhoods and slower pace appeal to families and retirees. Despite modest population growth, housing supply has remained steady. This balance helps prevent sharp price spikes and keeps the market within reach for many buyers.

London, Ontario

London continues to attract buyers seeking affordability without giving up urban conveniences. While prices rose in recent years, they remain lower than in major Ontario markets. The city benefits from strong employment across education, healthcare, and technology. Consistent population growth supports stable demand, but new housing construction has helped limit sharp increases. London’s varied neighbourhoods offer options for students, families, and retirees. Transit expansion and infrastructure investments have supported continued growth. The city’s balanced economy helps reduce volatility in housing prices. For many buyers priced out of the Greater Toronto Area, London stands out as a realistic and sustainable alternative.

Thunder Bay, Ontario

Thunder Bay remains one of Ontario’s most affordable cities with property values significantly below provincial norms. The local economy is supported by healthcare, education, and public-sector employment, which helps stabilize demand. Housing supply has stayed consistent, preventing rapid price swings. The city’s slower population growth allows buyers more time to enter the market. Thunder Bay’s neighbourhoods offer larger lots and lower carrying costs compared to urban centres. Its affordability appeals to remote workers and families searching for space at manageable prices. Despite broader market pressures, Thunder Bay continues to provide accessible homeownership options within a stable regional economy.

Sudbury, Ontario

Sudbury offers relatively affordable housing supported by steady employment in mining, healthcare, and education. Home prices remain below major Ontario markets, making the city attractive for first-time buyers. Its mix of suburban, urban, and rural neighbourhoods creates diverse options across price ranges. Local incomes align well with property values, helping maintain stable ownership levels. Sudbury’s ongoing infrastructure improvements and university presence contribute to a balanced market. Housing supply has generally kept pace with demand. This prevents sharp price increases and supports predictability for buyers. For many who want affordability with strong amenities, Sudbury remains a reliable choice.

Regina, Saskatchewan

Regina continues to offer some of the most affordable housing options in Western Canada. Home prices have remained stable due to balanced supply and demand. The city’s economy, supported by government, agriculture, and energy sectors, provides consistent employment. Local incomes match well with property values, keeping ownership rates strong. New developments across Regina ensure ongoing options for buyers. Property taxes and living costs remain manageable, adding to affordability. Market conditions have avoided the extreme fluctuations seen in larger provinces. For families and newcomers seeking stability and reasonable prices, Regina stands out as a dependable and accessible housing market.

Saskatoon, Saskatchewan

Saskatoon remains an affordable major city with housing prices that compare favourably to national averages. The city’s economy benefits from agriculture, technology, and education, supporting reliable demand. A steady pace of new construction has helped maintain affordability while accommodating growth. Neighbourhoods offer a mix of suburban and central options, appealing to varied buyers. Living costs remain manageable compared to larger metropolitan areas. Saskatoon’s expanding infrastructure and transit investments help support long-term stability. Local incomes align well with home prices, preventing the affordability challenges seen elsewhere. The market stays appealing for families, students, and young professionals entering ownership.

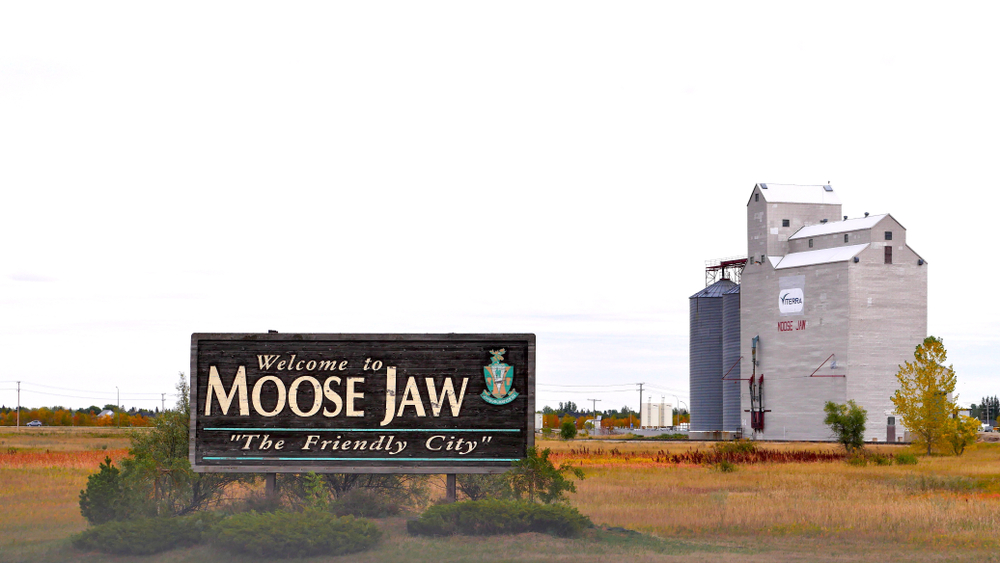

Moose Jaw, Saskatchewan

Moose Jaw continues to provide attractively priced homes within a stable Prairie market. Property values remain lower than those in nearby major cities, making it a practical choice for first-time buyers and retirees. The city benefits from steady employment in tourism, agriculture, and public services. Housing supply generally meets demand, keeping prices predictable. Living costs remain low, helping households manage monthly budgets. Moose Jaw’s slower pace of population growth prevents sudden market pressure. Buyers often gain access to larger lots and lower taxes. This combination makes Moose Jaw a compelling option for those prioritizing affordability and long-term stability.

Winnipeg, Manitoba

Winnipeg continues to offer relatively affordable housing compared to many Canadian urban centres. The city’s economy is diverse, supported by finance, manufacturing, and transportation. This helps maintain steady demand without dramatic price spikes. Housing supply has expanded in recent years, supporting balanced conditions. Local incomes align reasonably with home values, keeping ownership attainable. Winnipeg’s neighbourhoods range from historic districts to newer suburban developments, offering options across budgets. Property taxes and living costs remain manageable. Strong infrastructure and public services add to the market’s stability. For buyers seeking affordability in a major city, Winnipeg delivers practical and consistent value.

Brandon, Manitoba

Brandon remains one of the most affordable housing markets in Manitoba. Home prices stay well below national averages, making the city appealing to first-time buyers and young families. The local economy benefits from agriculture, food processing, education, and healthcare, providing stable employment. Housing supply has kept pace with population growth, helping prevent sharp price increases. Property taxes and utility costs remain manageable, supporting long-term affordability. Brandon’s neighbourhoods offer a mix of newer developments and established areas. Buyers gain access to larger properties at reasonable prices. For many households seeking value and stability, Brandon continues to deliver accessible homeownership opportunities.

Lethbridge, Alberta

Lethbridge offers a strong balance of affordability and urban conveniences. Home prices remain lower than in major Alberta cities, attracting buyers who want space without high costs. The local economy is diversified, supported by agriculture, education, healthcare, and small businesses. Population growth has been steady, but housing construction has kept supply available. Property taxes and living expenses remain reasonable, helping households manage budgets. Lethbridge’s neighbourhoods appeal to students, families, and retirees. Outdoor amenities and growing infrastructure add further value. The city maintains a stable real estate environment where buyers can enter the market without facing extreme price pressure.

Red Deer, Alberta

Red Deer continues to provide affordable housing between Alberta’s two largest cities. Property values remain accessible for first-time buyers, with many homes priced below provincial averages. The local economy benefits from agriculture, manufacturing, and trade services, supporting stable demand. New construction has added supply, helping prevent price volatility. Living costs, including utilities and taxes, stay manageable. Red Deer’s central location appeals to commuters and families seeking a quieter lifestyle. The market avoids the sharp fluctuations seen in larger regions. For households seeking affordability, variety, and a balanced pace of growth, Red Deer remains a dependable choice.

Prince George, British Columbia

Prince George remains one of British Columbia’s most affordable urban markets. Home prices sit well below those in coastal cities, attracting buyers looking for space and value. The economy is supported by forestry, manufacturing, and education, providing steady employment. Housing supply generally meets demand, keeping prices stable. Property taxes remain reasonable compared to major BC regions. Prince George offers larger lots and lower costs, appealing to families and remote workers. The city’s ongoing infrastructure investments support long-term growth. For many priced out of Metro Vancouver or Victoria, Prince George offers an attainable and sustainable route into homeownership.

Kamloops, British Columbia

Kamloops offers more affordable housing compared to BC’s major urban centres. The city benefits from steady employment in healthcare, education, and tourism. Home prices remain manageable, appealing to families and retirees. New construction has helped balance supply with demand, reducing market pressure. Kamloops’ diverse neighbourhoods provide options for buyers across budgets. Living costs, including property taxes and utilities, stay moderate for the province. Outdoor amenities and transportation links add to its appeal. Kamloops continues to attract residents seeking value without leaving British Columbia. Its stable growth pattern helps support consistent affordability within a competitive regional market.

Nanaimo, British Columbia

Nanaimo remains more affordable than many parts of Vancouver Island and the Lower Mainland. Home prices have grown but still sit below major BC markets. The local economy includes healthcare, retail, education, and emerging tech, supporting stable demand. Housing supply has expanded through new developments, helping maintain balanced conditions. Nanaimo appeals to retirees, remote workers, and families seeking coastal living at a lower cost. Property taxes and living expenses stay moderate for the region. The city’s ferry connections and amenities add convenience. For buyers wanting ocean proximity without the high costs of Victoria or Vancouver, Nanaimo remains a strong option.

22 Groceries to Grab Now—Before another Price Shock Hits Canada

Food prices in Canada have been steadily climbing, and another spike could make your grocery bill feel like a mortgage payment. According to Statistics Canada, food inflation remains about 3.7% higher than last year, with essentials like bread, dairy, and fresh produce leading the surge. Some items are expected to rise even further due to transportation costs, droughts, and import tariffs. Here are 22 groceries to grab now before another price shock hits Canada.

22 Groceries to Grab Now—Before another Price Shock Hits Canada