Car insurance in Canada comes with fine print that many drivers overlook. While some vehicle features seem harmless or even helpful, certain modifications and add-ons can void coverage or lead to denied claims. Insurance companies often view them as risky, unsafe, or outside standard policy terms. What seems like a small upgrade could end up costing thousands if an accident occurs. These are 12 car features that could invalidate your insurance in Canada:

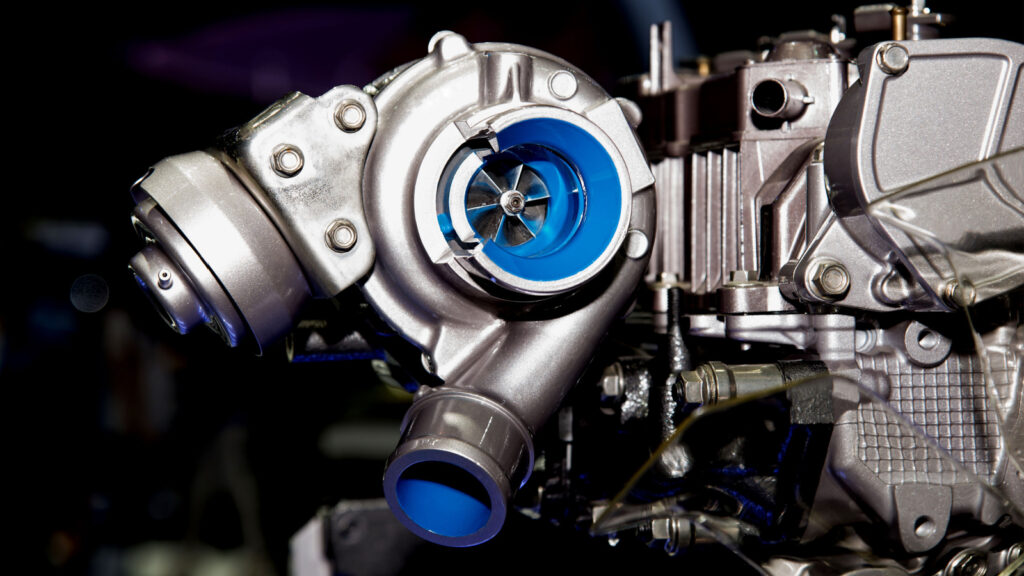

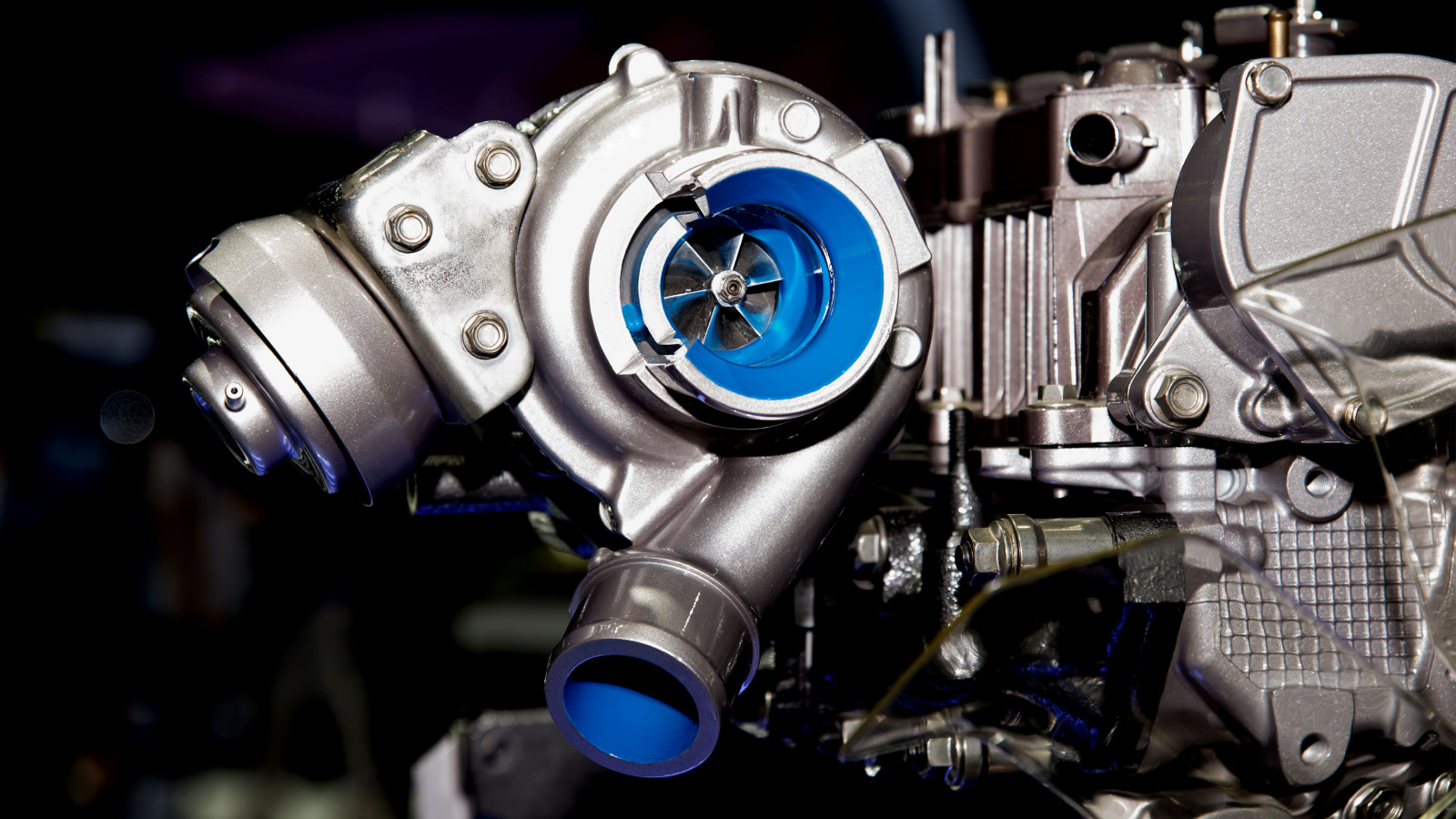

Aftermarket Turbochargers

Installing aftermarket turbochargers may seem like a way to boost performance, but insurers often see them as a major red flag. These modifications can significantly increase horsepower, which in turn raises the likelihood of speeding, mechanical failure, or accidents. Many insurance providers require disclosure of such upgrades, and failing to do so can result in policy cancellation or denied claims. Beyond insurance implications, turbochargers can strain a vehicle’s engine if not installed correctly. What feels like an exciting upgrade could leave a driver without coverage when it matters most, making this one of the riskiest add-ons for Canadian motorists.

Lift Kits

Lift kits are popular among off-road enthusiasts, but they can dramatically change a vehicle’s handling and safety profile. Raising a truck or SUV alters the center of gravity, which increases rollover risks. Insurers often require notification of such modifications, and failing to declare them can void coverage, and even when disclosed, premiums may spike because of the added risk. Lift kits also affect braking distances and visibility for other drivers on the road. While the rugged look is appealing, the insurance complications make this upgrade a costly gamble, making it a modification that does more harm than good.

Tinted Windows Beyond Legal Limits

Excessive window tinting may look sleek and offer privacy, but it can easily cross into illegal territory in Canada. Provinces have strict rules on how dark windows can be, especially on the front side glass, and if tint levels exceed regulations, insurers may refuse to honor claims after an accident. This is because illegal modifications can be seen as contributing to unsafe driving conditions, particularly at night. While mild tinting for UV protection is often acceptable, heavily tinted windows invite both tickets and potential coverage denial, as what seems like a minor style choice can actually leave a vehicle uninsured when trouble arises.

Non-Standard Rims and Oversized Tires

Custom rims and oversized tires are a favorite among car enthusiasts, but they can be a liability from an insurance standpoint. These modifications often affect vehicle handling, braking, and speedometer accuracy. Some insurers consider them high risk, particularly if the changes push the vehicle outside manufacturer specifications. At the same time, undisclosed modifications may result in denied claims, even if they didn’t directly cause an accident. Larger tires also place additional stress on suspension components, increasing the likelihood of mechanical failure. While flashy wheels turn heads, they can quietly undermine insurance coverage in Canada, creating financial headaches in the event of a crash.

Nitrous Oxide Systems (NOS)

Nitrous oxide systems deliver quick bursts of speed, but they also raise serious concerns for insurers. This modification dramatically increases acceleration, which can lead to reckless driving and severe accidents. Because of the extreme risks, many Canadian insurance companies refuse to cover vehicles equipped with NOS. Even if a driver never uses it, the mere presence of the system may be enough to void a policy. Beyond insurance, nitrous oxide installations are tightly regulated due to safety hazards. For those who value coverage and peace of mind, this feature is one of the fastest ways to lose both.

Roof-Mounted Light Bars

Off-roaders often use roof-mounted LED light bars for extra visibility, but they can create problems on public roads. These lights can dazzle other drivers and may violate provincial vehicle equipment laws. Insurance companies typically expect all modifications to comply with road safety standards, so an illegal or improperly installed light bar can result in denied claims. Even when installed legally, insurers may raise premiums because of the increased risk of distraction or accidents. While useful in remote areas, these lights can easily compromise coverage if misused in everyday Canadian driving conditions.

Roll Cages in Street Vehicles

Roll cages are designed to improve safety on racetracks, but when installed in street vehicles, they often raise red flags for insurers. The presence of a roll cage suggests that the car is being used for racing or high-risk driving, which can invalidate coverage. Additionally, roll cages can increase the risk of injury in everyday crashes if not paired with helmets and harnesses, as occupants may hit exposed bars. Insurance providers may cancel or refuse policies altogether once they discover this feature, and what was meant as a safety upgrade can ironically lead to less protection, both physically and financially.

Undisclosed Car Alarms or Immobilizers

Adding aftermarket security systems like car alarms or immobilizers may seem harmless, but failing to disclose them can affect coverage. Some systems interfere with a vehicle’s electrical wiring, which insurers view as a risk factor for fires or malfunctions. Others may not be compatible with factory-installed equipment, potentially complicating claims after theft or damage. If an insurer determines that a modification contributed to a problem, the policy may be invalidated. Even though these features are installed with good intentions, the lack of disclosure can turn a safety upgrade into a costly insurance mistake in Canada.

Neon Underglow Lights

Neon underglow lighting is a favorite among car customizers, but it falls into a gray area when it comes to Canadian vehicle regulations. Specific colors, such as red or blue, can be mistaken for emergency vehicles and are often prohibited. Insurers typically expect vehicles to remain within legal guidelines, so claims can be denied if these lights are found to be illegal. Even when technically legal, they may still signal risky driving behavior, which can impact premiums. A glowing car may draw attention on the street, but it can also attract unwanted consequences from both law enforcement and insurance companies.

Modified Exhaust Systems

Loud or oversized exhaust systems are popular among car enthusiasts, but they frequently create insurance issues. Modified exhausts may violate provincial noise regulations or emissions standards, making them a liability, and insurers often deny coverage for vehicles that don’t comply with local laws, regardless of whether the exhaust contributed to an accident. Beyond legality, these systems can raise concerns about aggressive driving and mechanical strain. While the growl of a modified exhaust may be satisfying, the potential loss of coverage makes it an expensive sound.

In-Car Entertainment Systems

Oversized screens, gaming setups, or custom audio systems can seem like harmless luxuries, but they often increase insurance risks. These systems can distract drivers or lead to theft, both of which insurers take seriously. If a claim involves distracted driving or electrical issues linked to modifications, coverage may be denied. In some cases, insurers require additional premiums to cover these upgrades, and failure to disclose them can void a policy entirely. While flashy in-car entertainment setups may impress passengers, they can quietly undermine the foundation of insurance protection in Canada’s strict regulatory environment.

Radar Detectors

Radar detectors are banned in many Canadian provinces, including Ontario, Quebec, and Manitoba. Even in regions where they’re legal, insurers may view them as a sign of risky driving behavior, and having one installed can lead to higher premiums; in some cases, it may even invalidate coverage altogether. Law enforcement also imposes steep fines and equipment seizures for banned devices. While drivers may see radar detectors as a way to avoid tickets, insurance companies interpret them as a willingness to speed. This small device carries outsized financial risks that extend well beyond traffic penalties.

21 Products Canadians Should Stockpile Before Tariffs Hit

If trade tensions escalate between Canada and the U.S., everyday essentials can suddenly disappear or skyrocket in price. Products like pantry basics and tech must-haves that depend on are deeply tied to cross-border supply chains and are likely to face various kinds of disruptions

21 Products Canadians Should Stockpile Before Tariffs Hit