A growing group of Canadian companies has been outperforming many well-known Silicon Valley names by taking a different approach to innovation, scale, and long-term strategy. These firms focus on practical problem-solving, sustainable growth, and technical depth rather than depending on hype cycles. Their progress across artificial intelligence, clean energy, fintech, quantum research, enterprise software, and digital infrastructure shows how diverse the country’s tech landscape has become. Here are 23 companies outsmarting Silicon Valley.

Shopify

Shopify built a commerce infrastructure that gives independent sellers the same tools used by major retailers. While Silicon Valley platforms focused on advertising-driven ecosystems, Shopify concentrated on enabling businesses to own their customer relationships, payment systems, and data. Its strategy attracted millions of merchants who wanted flexibility without depending on marketplace algorithms. The company expanded through logistics tools, global payment systems, AI-driven personalization, and enterprise-grade solutions used by major brands. Its ecosystem of apps and developers grew into a competitive advantage that few U.S. rivals have matched. The platform continues to reshape how digital retail operates worldwide.

Lightspeed Commerce

Lightspeed created a retail and restaurant platform that handles inventory, payments, ordering systems, analytics, and customer management in one place. Many Silicon Valley competitors tried building isolated features, but Lightspeed focused on unifying operations for businesses that manage large real-world inventories. This approach attracted multi-location restaurants and retailers that needed accuracy at scale. The company’s growth accelerated through targeted acquisitions that added loyalty programs, advanced payments, and restaurant menu tools. Its cloud-first model supports businesses across dozens of countries. The platform’s strength comes from reliable performance in environments where errors directly affect revenue, something Silicon Valley underestimated.

OpenText

OpenText became a global leader in enterprise information management by focusing on secure data handling across highly regulated industries. Instead of chasing consumer markets, the company built long-term relationships with governments, financial institutions, and healthcare networks that require strong compliance and audit controls. Its tools manage documents, records, automated workflows, cybersecurity, and analytics for organizations with complex operational demands. OpenText’s strategy relies on stability and scale rather than rapid feature cycles. Its acquisitions consistently expand capabilities in cloud security, business integration, and embedded analytics. This measured approach placed it ahead of many Silicon Valley firms in enterprise-grade information systems.

Element AI

Element AI prioritized enterprise solutions when most AI startups focused on consumer applications. By working directly with financial institutions, manufacturers, insurers, and supply chain operators, it built systems that solved specific operational challenges. The company invested heavily in research partnerships with universities, giving it access to a strong talent base. Its tools supported document classification, risk assessment, workflow automation, and predictive maintenance. While Silicon Valley concentrated on public-facing AI products, Element AI focused on problems where accuracy mattered more than speed. Its acquisition by ServiceNow demonstrated how valuable its enterprise-focused intellectual property became within the global AI ecosystem.

Coveo

Coveo specializes in AI-powered search and personalization for enterprise clients. Instead of targeting broad consumer markets, the company worked with retailers, service providers, and large corporations that required precise recommendations supported by real-time data. The platform integrates with service desks, e-commerce systems, and internal databases to deliver relevant results to employees and customers. This focus on enterprise search positioned Coveo ahead of several U.S. competitors that prioritized general web search. The company uses machine learning to refine responses based on user behavior, improving relevance at scale. Its long-term success comes from serving clients who depend on accurate information.

Wattpad

Wattpad built a storytelling platform that turned user-generated fiction into a pipeline for publishing and entertainment. While Silicon Valley companies are centered on short video and social networking, Wattpad focuses on long-form writing communities and data-driven talent discovery. The platform identified stories gaining traction and connected authors with publishers, studios, and production partners. This model produced multiple book deals, films, and streaming projects. By supporting emerging writers rather than competing for mainstream attention, Wattpad created a dedicated global audience. Its acquisition by Naver further expanded its reach, showing how influential community-centered storytelling became outside traditional tech hubs.

Deep Genomics

Deep Genomics uses machine learning to discover genetic therapies, a complex field that requires precision, long research timelines, and strong scientific foundations. While Silicon Valley startups often pursued broad health tech concepts, Deep Genomics focused on specific therapeutic pathways supported by detailed biological data. The company built an AI system capable of predicting how genetic changes influence disease and how potential treatments might perform. This approach shortens development cycles and reduces uncertainty for pharmaceutical partners. Its progress gained attention from global biotech investors. The company’s expertise in combining computational models with scientific research sets it apart from more generalized U.S. biotech firms.

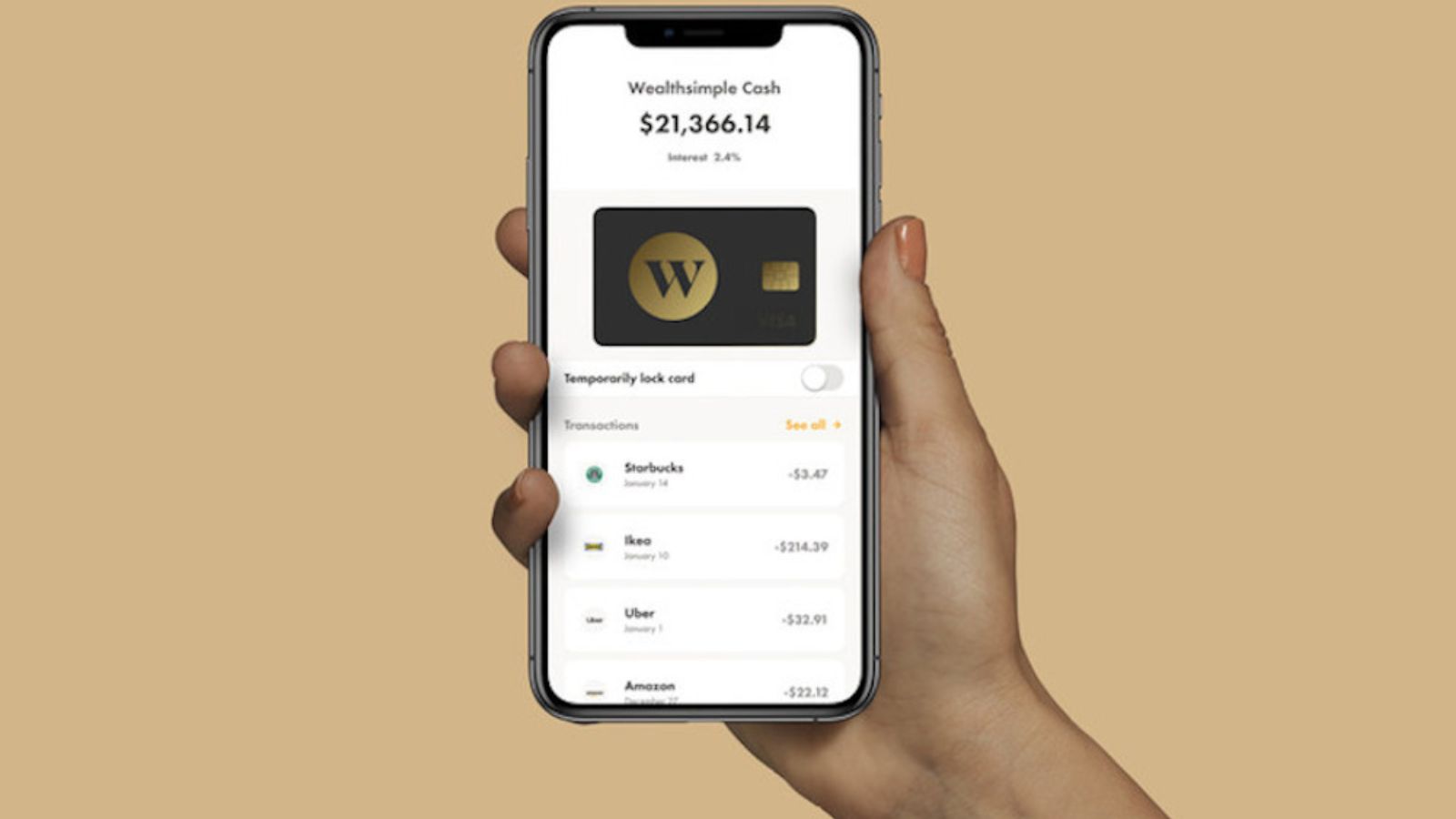

Wealthsimple

Wealthsimple grew by simplifying financial services for users who wanted accessible investing without complex interfaces. Silicon Valley fintech platforms targeted rapid scaling and broad feature sets, but Wealthsimple prioritized clear design, strong compliance, and transparent fee structures. The company expanded into cryptocurrency, tax filing, cash accounts, and fractional investing while maintaining ease of use. Its branding focused on trust and straightforward communication, building loyalty among younger investors. Partnerships with established institutions strengthened its regulatory position. By balancing innovation with reliability, Wealthsimple created a financial platform that competes with U.S. giants while maintaining a model that appeals to users seeking stability.

Hootsuite

Hootsuite became a widely used social media management tool by addressing the operational needs of marketing teams rather than building another consumer platform. It provided scheduling, analytics, monitoring, and collaboration features that allowed businesses to manage multiple accounts efficiently. Silicon Valley firms focused on standalone publishing apps, but Hootsuite built an ecosystem that connected directly with major networks. Its enterprise tier attracted global brands looking for oversight tools. The company’s training programs and certifications further strengthened its role in professional marketing. By offering practical solutions instead of competing for user attention, Hootsuite established a durable niche in digital communications.

Benevity

Benevity developed software that helps companies manage donations, volunteer programs, and social impact initiatives. Instead of following Silicon Valley’s focus on consumer-facing apps, it targeted corporate responsibility departments that needed secure systems to track employee engagement and global giving. Its tools support large organizations with thousands of workers across multiple locations. Benevity’s strength lies in its ability to integrate with HR platforms while meeting international compliance requirements. The company became a major player in workplace philanthropy by providing accurate reporting and scalable infrastructure. Its approach turned corporate giving into a structured process that supports long-term social impact goals.

Clio

Clio created cloud-based legal practice software for law firms, aiming to modernize operations. Silicon Valley startups often overlooked legal tech because of regulatory complexity, but Clio addressed document management, billing, scheduling, client intake, and collaboration in a single system. The platform supports firms of all sizes and integrates with accounting and productivity tools. Strong security and compliance features helped it gain trust from legal professionals. Clio’s focus on reducing administrative workload allowed firms to improve client service and efficiency. This clear operational value helped the company expand rapidly across international markets while becoming a leader in legal technology.

Dapper Labs

Dapper Labs introduced blockchain-based digital collectibles through products like NBA Top Shot. When Silicon Valley focused on broad cryptocurrency platforms, Dapper Labs concentrated on accessible experiences that connected directly with sports and entertainment fans. Its Flow blockchain was designed to handle large transaction volumes without the congestion issues seen in other networks. Partnerships with major leagues and brands helped the platform scale quickly. By emphasizing user-friendly design and verified digital ownership, the company attracted mainstream audiences unfamiliar with blockchain. This strategic focus allowed Dapper Labs to compete effectively in a field often dominated by technical complexity and speculation.

ApplyBoard

ApplyBoard built a platform that simplifies international student recruitment by centralizing applications, documentation, and admissions guidance. While Silicon Valley concentrated on general online education tools, ApplyBoard focused on the increasingly complex process of studying abroad. Its partnerships with universities and colleges created a large network of verified programs supported by dedicated advisors. The platform provides students with personalized recommendations and clear instructions, reducing barriers to global education. Schools benefit from streamlined recruitment and reliable applicant data. ApplyBoard’s operational approach solved real administrative challenges, allowing it to expand across multiple countries while serving institutions that wanted structured digital processes.

PointClickCare

PointClickCare developed software that supports long-term and post-acute care providers. Silicon Valley often prioritized hospital and primary care technologies, but this company addressed the needs of nursing homes, senior care facilities, and home health organizations. Its platform manages records, billing, scheduling, medication tracking, and clinical workflows. Focusing on continuity of care helped providers improve outcomes for older adults. PointClickCare’s detailed understanding of regulatory requirements allowed it to build tools that match the operational realities of the sector. This specialized expertise enabled the company to become a leader in an area largely ignored by larger tech firms.

Clearco

Clearco created a funding model that offers revenue-based financing to e-commerce businesses. Instead of following Silicon Valley’s preference for equity-driven venture capital, Clearco provided growth capital without requiring founders to give up ownership. The platform uses data to evaluate sales performance and determine investment amounts. This approach attracted online brands seeking flexible financing tied directly to revenue. Clearco expanded globally by offering quick approvals and transparent repayment structures. Its model appealed to founders who wanted predictable funding without complex negotiations. By rethinking how companies access capital, Clearco built a strong position in the alternative financing space.

North

North, formerly Thalmic Labs, developed smart glasses designed for everyday use. While Silicon Valley companies pursued multifunctional devices with complex interfaces, North focused on a lightweight product that delivered notifications, navigation, and simple interactions without overwhelming users. Its early success came from prioritizing comfort and practicality over attempting to replace smartphones. The company attracted global attention by showing how wearable technology could be discreet and accessible. Although later acquired by Google, North demonstrated that specialized hardware design could originate outside traditional tech hubs. Its approach challenged assumptions about how wearable devices should function in daily life.

Ritual

Ritual created an order-ahead platform for restaurants and cafes that encouraged group participation among office workers. Instead of competing directly with large Silicon Valley delivery apps, Ritual focused on pickup transactions, which allowed restaurants to avoid high commission fees. The platform’s group ordering feature increased efficiency during busy periods and encouraged repeat use. Businesses adopted Ritual as a workplace perk, improving access to local restaurants. By solving logistical issues for both consumers and merchants, the company built loyalty in dense urban areas. Its targeted strategy differentiated it from larger delivery platforms that prioritized broad geographic expansion.

Fispan

Fispan built an integration platform that connects banks with enterprise resource planning systems. Silicon Valley fintech often centered on consumer payments, but Fispan targeted the operational needs of large organizations that manage high-volume transactions. Its tools automate workflows between banks and internal accounting systems, reducing errors and improving reconciliation. This functionality is critical for businesses that require precise financial controls. By providing secure, standardized connections, Fispan helped financial institutions modernize without replacing legacy infrastructure. The company’s specialized position allowed it to serve a niche where accuracy and reliability were more important than rapid consumer scale.

Genetec

Genetec developed security and surveillance systems used by airports, cities, retailers, and transportation networks. Instead of competing in consumer smart camera markets popular in Silicon Valley, it concentrated on large-scale physical security environments. Its platform integrates video monitoring, access control, and analytics into a single interface. The company’s strength lies in ensuring reliability during high-stakes situations where downtime is unacceptable. Genetec also invests heavily in privacy and cybersecurity practices that meet strict international standards. This focus on operational integrity helped it earn trust from organizations responsible for critical infrastructure and public safety across global markets.

Kinaxis

Kinaxis built supply chain management software designed for organizations dealing with complex global operations. While Silicon Valley offered general productivity tools, Kinaxis focused on real-time planning that helps companies adjust quickly to disruptions. Its platform enables scenario analysis, demand forecasting, and inventory optimization supported by detailed data models. Clients include major manufacturers that depend on accurate planning to maintain efficiency. Kinaxis gained recognition for its strong performance during periods of global supply chain instability. The company’s ability to provide visibility across multiple regions and suppliers positioned it as a leader in a field where reliability determines competitiveness.

Rewind

Rewind offers backup solutions for cloud-based applications like Shopify, QuickBooks, and GitHub. Silicon Valley often emphasized speed and feature expansion, but Rewind focused on data protection and recovery tools that reduce business risk. Its service automatically backs up critical information and allows users to restore previous versions with minimal effort. Businesses rely on this level of protection to prevent data loss from human error or software issues. Rewind’s clear focus on reliability helped it scale across multiple platforms. The company’s emphasis on safeguarding operational information set it apart in an industry where many competitors overlook backup systems.

Ecobee

Ecobee developed smart home thermostats that prioritize energy savings and user control. While Silicon Valley competitors expanded into broad home automation ecosystems, Ecobee focused on delivering accurate temperature control supported by room sensors and detailed data insights. Users could manage heating and cooling patterns to reduce energy consumption and costs. The company’s products appealed to homeowners who wanted practical improvements rather than extensive automation. Integration with major voice assistants and utility programs helped Ecobee gain wide adoption. Its commitment to straightforward functionality allowed it to compete effectively with larger U.S. brands in the smart home technology sector.

Faire

Faire built a wholesale marketplace that connects independent retailers with brands. Rather than relying on traditional distribution channels, it introduced flexible payment terms, easy reordering, and data-driven product recommendations. Retailers use the platform to discover new suppliers without attending trade shows or managing complex logistics. Brands benefit from transparent analytics and access to thousands of small businesses. By concentrating on wholesale relationships rather than consumer sales, Faire created an efficient system well aligned with modern retail needs. Its growth across North America and Europe demonstrated how targeted marketplace design can outperform broader, less specialized Silicon Valley platforms.

21 Products Canadians Should Stockpile Before Tariffs Hit

If trade tensions escalate between Canada and the U.S., everyday essentials can suddenly disappear or skyrocket in price. Products like pantry basics and tech must-haves that depend on are deeply tied to cross-border supply chains and are likely to face various kinds of disruptions

21 Products Canadians Should Stockpile Before Tariffs Hit